Capital Markets and Finance

After the chaos and uncertainty of the last year, commercial real estate experts are finally getting a clearer idea of what the real value of real estate should be, according to attendees of the recent ULI McCoy Syposium. That starts with a growing consensus that interest rates are not likely to return to the rock-bottom lows that persisted for much of the last 15 years.

Commercial real estate investors are hitting refresh on stodgy investment strategies and sending more capital flowing into alternative property sectors. Portfolio managers that were once laser-focused on traditional property sectors are expanding strategies to include bigger allocations beyond the typical mix of office, retail, industrial, and multifamily assets.

Commercial real estate already faces many challenges because of an unprecedented rise in interest rates, tightening credit capacity, uncertainty in the office market, a $2.6 trillion wave of maturing debt over the next four years, and overall economic anxiety. Adding to this complexity, financial regulators are pushing for a significant increase in capital requirements—by as much as 20 percent—for the nation’s largest banks via the Basel III “endgame.”

In a market accustomed to abundant supplies of cheap debt, the real estate landscape in the Asia Pacific region is undergoing a significant transformation following the series of rapid interest rate hikes initiated by the U.S. Federal Reserve since mid-2022, according to the 18th edition of the Emerging Trends in Real Estate® Asia Pacific 2024. In the absence of asset revaluations, far fewer deals are now able to deliver accretive returns, prompting large global investors to retreat to the sidelines as they wait for markets to reset

ULI MEMBER-ONLY CONTENT: According to the latest ULI Real Estate Economic Forecast, investors are expected to buy just $312 billion in commercial real estate in 2023. That’s a fraction of the volume of sales in 2021 and $100 billion less than expected in the spring forecast just six months ago.

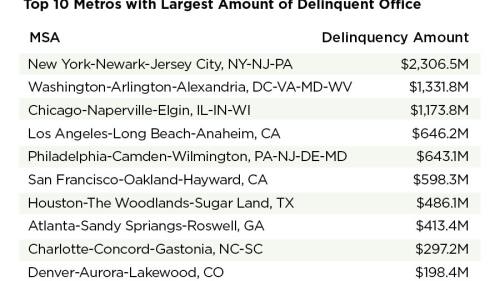

Many office property owners are heading for the exits amid weaker demand and looming debt maturities, while opportunistic private equity groups are leaning in to capture what could be once-in-a-generation buying opportunities.

Real estate economists continue to expect a slowdown in the U.S. economy and real estate markets over the next year, consistent with their outlook six months ago, according to a ULI survey. The economy will slow meaningfully in 2024 before improving in 2025. The Real Estate Economic Forecast, produced by the ULI Center for Real Estate Economics and Capital Markets Estate, is based on a survey including 39 economists and analysts at 35 leading real estate organizations.

As interest rates have risen, crowdfunding platforms have returned as a viable source of capital for developers.

Although deals are still getting done, it is a tough market to find capital to fund acquisitions and development, and the need to deleverage maturing loans in a higher rate environment is fueling concerns about rising commercial real estate loan stress. That challenging market is evident in slumping transaction activity.

Although residential fell more in the first quarter of 2023, office remains Europe’s most scarred commercial real estate sector, according to advisory firm Green Street. Government mandates around sustainability are also tightening, and Cushman & Wakefield says 76 percent of European office space could be obsolete by 2030 unless landlords start investing now.