Change is in the air. Amid a generally rosy outlook—84 percent of respondents in the Emerging Trends in Real Estate 2016 report compiled by ULI and PwC believe the market is good to excellent—a perception lingers that it could all change quickly.

That optimism, tempered by a dose of realistic pessimism, permeates the latest Emerging Trends results. Respondents say plenty of opportunity exists across markets and sectors, but risk remains, and the focus is on smart, data-driven projects that address the profound changes happening in cities.

It appears that the real estate industry is looking to play a combination of offense and defense. “There is enough uncertainty that people are not willing to give up defensive positions,” said Andrew Warren, director of real estate research at PwC.

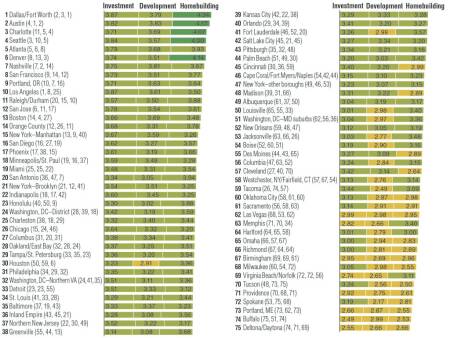

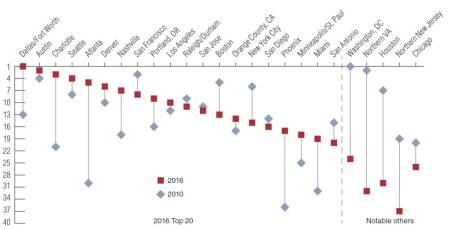

Yet, eight of the top ten cities identified by respondents as the most favorable for investment and development in 2016 are secondary cities, sometimes called 18-hour cities. There is greater risk in such cities, but they offer better opportunities and the potential for larger yields than the traditional gateway cities, survey respondents said.

“More and more of these cities are gaining a competitive edge by positioning themselves as vibrant, more affordable places to live and work, with amenities that appeal to different generations,” said ULI Global Chief Executive Officer Patrick L. Phillips.

Successful projects will place a premium on smart design, a clear target audience, and a long-term analytical focus, survey respondents said. Memories of the most recent crash clearly are still fresh in the minds of many industry executives. Economists and analysts who participated in the survey agreed that the current cycle is likely to peak within the next three years.

“I’m not calling for the economy to go south, but change is coming,” said Mary Ludgin, director of global investment research for the Heitman real estate investment management firm, during a panel at the 2015 ULI Fall Meeting in San Francisco. “We’re closer to a recession than not.”

Emerging Trends 2016 emphasizes the fundamental transitions happening in cities around the United States. The report’s authors note that millennials will make up 44 percent of the workforce in 2026. Autonomous cars and a greater focus on walkable, transit-rich communities will be a reality. Offices will be smaller; industrial space will be more efficient; and there will be greater need for new forms of commercial space. “A key component is: what is a suburb?” Warren asked. “The definition is evolving.”

This year’s edition of Emerging Trends reveals an industry looking for creative opportunities, finding innovation and new approaches to continue to grow. At the same time, there is a renewed focus on fundamentals, using data and smart analysis to connect the right projects, at the right time, in the right place.

18-Hour Cities 2.0

More investment dollars are flowing to 18-hour cities, following a trend highlighted in the 2015 issue of the report. For many investors and developers, 18-hour cities are moving from secondary status to a top priority as core markets grow more expensive. Both domestic and international investors are casting a wider net, looking for deals. That is why, among the top ten markets identified by respondents (Dallas/Fort Worth; Austin; Charlotte, North Carolina; Seattle; Atlanta; Denver; Nashville; San Francisco; Portland, Oregon; and Los Angeles), all but two (San Francisco and Los Angeles) are considered 18-hour cities. What is the attraction? Cities like Austin, Denver, San Diego, and San Antonio are magnets for entrepreneurs. And lower cap-rate compression translates as opportunity for higher yields than available in the major gateway cities. These smaller markets may be riskier than the big coastal cities, but improved data and constraints on supply could minimize the downside, the report concludes.

The Suburbs: Evolving

The suburbs are not dead. But a much different type of suburb is developing. “Diet urban” areas with mixed-use projects and strong transportation connections are drawing millennials. Jobs are the key. In the top 40 metro areas, 84 percent of jobs are outside the city center, the study notes. Younger buyers still prefer cities, but a growing number of these buyers say they want to move to the suburbs eventually, especially as downtown prices soar. In a recent survey by ULI, America in 2015, 37 percent of millennials said they wanted to live in a city and 29 percent said they wanted to live in the suburbs—which is not a very large spread. Many respondents say millennials are likely to migrate to the suburbs, just like the baby boomers did. Dense communities within 20 minutes of the city center are preferred by three out of four millennials, according to America in 2015.

Offices: A Barometer

Employment is growing, driving down office-space vacancies and boosting rents. But here is the key statistic: 46 percent of job growth since 2013 has been in companies with fewer than 50 employees. That means new types of offices are needed, as the trend toward open plans and creative workspace continues. “This is a significant opportunity” for office landlords, according to the study. Micro offices and shared environments remain popular. Coworking space firms have become “a major office leasing force” in many markets. The need for repositioning and reuse of existing assets was a common theme among respondents.

Housing Options

Homeownership rates are declining (slightly) in the United States. According to the most recent U.S. Census Bureau data, slightly less than 64 percent of Americans own homes, following a steady decline from the peak of 69 percent in 2004. That means a sharp pencil will be needed to create the best products in the right markets. The winning providers will find the right mix of rental, affordable housing, and creative options to meet the needs of a shifting population. Tools such as tax credits, flexible zoning, private/public partnerships, and land trusts will grow in importance. Design also will become more important, with concepts like micro housing and cohousing helping address scarce resources and new lifestyle choices among buyers.

Parking

A shift is taking place regarding the amount of parking considered necessary—or desirable. Recent projects in Seattle, Minneapolis, and Miami with strong walkability and transit options were able to cut back on parking spaces—with those cities’ approval. Even in the most car-centric cities, changes are in the works. Autonomous cars are right around the corner, experts say, and car-sharing services are growing. The number of miles traveled by car by people 34 years old or younger is already dropping, according to one recent study. Increasingly, surface parking lots and massive parking structures no longer appear to be the best use of land and resources. Lowering construction costs was cited as a key issue for the industry; finding alternatives to parking garages would be a good start.

Infrastructure

Infrastructure is getting sexy. More than $3.6 trillion in infrastructure spending is needed by 2020, according to the American Society of Civil Engineers. In light of urban population growth, cities are looking to prioritize repair and maintenance, and at the same time tackle critical needs in areas such as water supply and distribution, public education, aviation, vehicle and pedestrian traffic, and rail safety. Governments will focus on urgently needed repairs first, leaving the door open for creative solutions. One idea that may gain in popularity: high-frequency bus networks, which provide more capacity, superior flexibility, and lower cost than fixed-rail systems. The private sector can also find opportunities in the funding vacuum. Real estate investment trusts (REITs) and public/private partnerships are only the start. State and local governments are stepping up with rebates and tax advantages for green infrastructure, such as permeable pavement, green rooftops, and rainwater harvesting, all designed to aid water management. Cities that deal with the issues well will thrive; those that do not will be “competitively disadvantaged,” the study concludes. As the need to do more with less becomes more acute, innovative solutions to infrastructure needs are likely to mark the latter half of this decade and beyond.

Urban Food

Urban farming is turning from fad into a fixture as a local food source. While hardly a threat to global agribusiness, hundreds of thousands of tons of food are being grown today in cities like Chicago, Detroit, and New York. Agriculture is a productive and efficient use of hollowed-out sections of a city. This fits nicely with the growth of specialty restaurants and consumers’ growing interest in fresh, locally sourced food. But the trend is not necessarily about “foodies”—it is about finding a creative and productive reuse for city land.

Consolidation and Specialization

Either go big or go small, respondents say. Players in the middle will either have to link up with a bigger player or develop a laser focus on niche projects that require special talents. Big projects are dominated by major companies with the resources and capital to tackle the long-term challenges. Lenders remain conservative, placing a wide array of demands on big projects, making it difficult for aspiring players. Meanwhile, more niche lenders are funding smaller projects, which often represent the most innovative developments. Smaller banks are actively looking for deals in the range of $20 million to $50 million. More opportunity—and less risk—are found in the ultra-targeted, small-range projects, respondents say.

Deploying Capital

Little disagreement exists that money will continue to flow to real estate in the short term. Total acquisition volume hit $497.4 billion for the 12 months ending June 30—a 25 percent increase from the same period a year earlier. But where will the next round of capital go? The answer: to new markets (such as those 18-hour cities); to alternative assets, from cellphone towers to infrastructure; to renovation and redevelopment deals; and to alternative property types, such as medical offices and senior housing. Investors are looking at the entire spectrum of opportunities, unconstrained by geography or traditional property types, respondents say.

The Human Touch

Technology is no longer the answer to every question. Plenty of software packages exist that can dissect the numbers for deals. But history has shown that algorithms alone are not enough to determine the wisdom of an investment or a project. Equations can be “out of date in the blink of an eye,” the study notes. Elements like trust and human decision making are making a comeback. The trend is toward “intensively active management,” emphasizing human interaction and analysis, more than simply the data. Call it the “return of the humans,” the study suggests.

Markets

The slow shift from gateway markets to secondary cities is turning into a tidal wave, based on the Emerging Trends survey results. Smaller, 18-hour cities dominated this year’s list of top markets to watch. Volatility and risk are still part of the equation, but if one were to sift through job, demographic, and business data, the secondary markets represent a better opportunity for yields, respondents say.

How different is this brave new world? Last year’s number-one city, Houston, fell to number 30 in this year’s survey. That might be attributed to the woes of the oil industry, but San Francisco, Boston, Manhattan, and Chicago also slid dramatically in the rankings. Meanwhile, Nashville, Atlanta, and Portland jumped into the top ten.

The big markets remain attractive as solid defensive plays, but prices there are too high to achieve significant yields, survey respondents said.

The report’s overall themes are reflected in the analyses of this year’s top five markets:

Dallas/Fort Worth: Job growth and an attractive cost of doing business helped catapult the Dallas/Fort Worth area to the top of the list for 2016. Concerns about overbuilding are starting to pop up, but, overall, respondents see a business-friendly environment with solid fundamentals to justify more development.

Austin: A perennial favorite, Texas’s capital of hip continues to post strong economic and real estate growth. People simply want to live in Austin, making single-family and retail particularly popular with respondents. But the outlook for all property categories is well above average.

Charlotte: Housing is seen as the strongest market sector in the largest city in North Carolina. Industrial and hotels also are seen as growth sectors, fueled by the expanding local economy. A slowdown in the banking industry—a big local employer—is a risk factor, but the development of urban centers continues to make Charlotte an appealing place to live.

Seattle: Another city that often shows up near the top of the list, the Emerald City has been able to sustain growth with a diversified economy. There are “legitimate constraints on supply,” the report says, keeping the housing market strong. And demand remains strong throughout the commercial sectors, although respondents cited the lack of development opportunities as a negative.

Atlanta: Georgia’s capital lies in the sweet spot for growth and new supply. Few oversupply issues exist, yet demand is increasing based on the growing economy and relocations. Respondents liked all elements of the market, including the availability of financing.

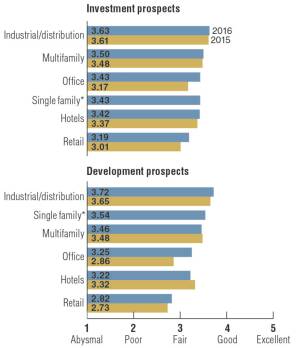

Property Types

Growth is expected in the next year over most property categories, according to survey respondents. But some sectors are slowing, and there are several red flags.

Industrial: The most popular sector among respondents is expected to reap the benefits of the growth of technology companies and rapidly expanding e-commerce. Fulfillment centers and warehouse industrial space are seen as the top prospects for investment and development. Investors like the 6.9 percent average cap rate, triple-net leases, and an annual capital appreciation rate hovering around 8.1 percent.

Apartments: The darling of the industry over the last decade is still going strong, but respondents expect that to change in the near future. There has been too much building, and rents cannot be sustained, some say. But many respondents remain bullish, believing that, in the wake of the housing market collapse, a large segment of the population prefers to rent. Demand will come from very specific targeted markets, from small young families to single seniors.

Office: The gap between the performance of central business district and suburban office space has grown in recent years. Institutional investors still prefer the low volatility of downtown markets in gateway cities, but transactions are up in the suburbs. Denser, creative office spaces are still in demand, but the pendulum may be swinging back toward traditional space. Medical offices ranked third, behind fulfillment centers and industrial space, on the list of favored property types for investment and development.

Hotels: Following the conflicting themes found in many parts of the report, the overall development and investment outlook for hotels is up from last year, but respondents were still pessimistic. More respondents rated full-service hotels a “sell” rather than a “buy” (31 percent versus 25 percent). Markets have been tight, but sharing services like Airbnb and HomeAway are adding supply and affecting the industry’s metrics.

Retail: Retail has notched the highest returns in property in two of the last three years. But the market is burdened by slow sales growth, limited store openings, store closures, and a supply of “crippled” retail centers, according to the report. Income growth and the economy will dictate the fate of many sites. Neighborhood and community shopping centers were labeled as good investment prospects, and top-tier malls are expected to continue to perform well.

Housing: Normalcy is the new goal. Inventories of new homes are hitting historical averages, and many cities are starting to see price increases as supply tightens. But ready-to-build lots remain lacking, and banks remain wary of development loans. Senior housing and infill and urban housing are listed as the sectors with the best prospects for 2016. Master-planned communities, often in the form of new urbanist projects in the suburbs, are increasing in popularity.

Kevin Brass is a San Diego–based regular contributor to the New York Times, the Wall Street Journal, and Ozy.com.