News

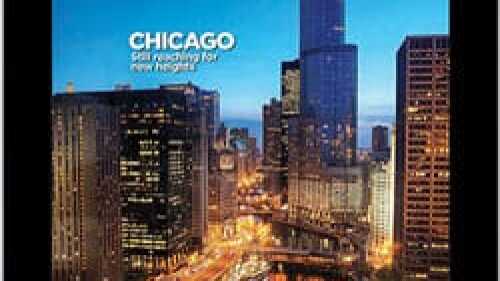

Those attending the Institute’s 2013 Fall Meeting in Chicago November 5–8 will find it easier to get the most out of the event thanks to a new mobile app for iPads, iPhones, and other smartphones capable of browsing the web. The free app is designed to help attendees plan their schedules, communicate with each other instantly through Twitter, comment on programs—and even find nearby restaurants.

Notwithstanding recent talk of an inflection point or a pause in transaction activity, sales of commercial property continued to increase quarter over quarter, reaching almost $90 billion for the third quarter of 2013. According to Real Capital Analytics, 2013 sales “will easily” exceed 2012’s $300 billion.

This fall, Urban Landwill be available for the first time as an app for tablets and smartphones on either Apple’s iOS operating system or Google’s Android. As a preview, the Urban Land magazine app will offer our September/October issue free of charge to anyone wishing to download it. Starting with the November/December issue, an authentication feature that restricts access to ULI members will be added.

A new U.S. forecast from the Urban Land Institute and EY projects continued improvement for real estate capital markets and commercial real estate fundamentals. The latest findings reveal high expectations for growth in the housing sector, as well as improved confidence about commercial mortgage–backed securities (CMBS) issuance, existing single-family housing prices, and industrial-sector fundamentals when compared to responses from just six months ago.

Real Estate Research Corporation’s most recent survey of the attitudes of institutional investors shows a marked change in buy, sell, or hold responses compared with a year ago. For example, the buy percentage of investors focused on acquiring office properties in central business districts (CBDs) declined from 38 percent in the third quarter of 2012 to 20 percent in the third quarter of this year.

The Trepp survey for the period ending October 4, 2013, showed the market treading water, waiting for some direction as to the solution to the issues being argued in Congress and with the president.

If the debt ceiling is not increased and the United States defaults (technically or actually) on its obligations, the consequences are thought by most experts to be dire, including substantial declines in the stock market, large increases in short- and long-term interest rates, and an economy rapidly entering into a deep and serious recession.

The mayors of Honolulu, Hawaii; Indianapolis, Indiana; Memphis, Tennessee; and Portland, Oregon, have been selected as the 2013–2014 fellows for the ULI Daniel Rose Center for Public Leadership. The mayor of each city will lead a team of three fellows and a coordinator who together will select a local land use challenge on which they will receive technical assistance from faculty experts assembled by ULI and their peers from the other three fellowship cities.

ULI has selected Jason L. Ray as its new chief technology officer. Ray most recently served as the head of technology for the GAVI Alliance, a public/private global health partnership originally chaired by Nelson Mandela and established with a $750 million donation from the Bill and Melinda Gates Foundation.

Two-time governor of Florida Jeb Bush will deliver the closing keynote address at the ULI Fall Meeting in Chicago November 5–8. Other speakers will include: Sam Zell, founder of Equity Group Investments and chairman of Equity International; Dan Pelino, general manager, Global Public Sector, IBM; and Cia Buckley, chief investment officer of Dune Real Estate Partners.