Summary

This month’s data remain weak and offer little to support broad-based momentum in either the economy or the real estate market. The few instances of positive figures are encouraging, but they are not yet of sufficient quantity and the numbers are not at a high enough level to point to robust recovery.

More commentary and data can be found throughout the tabs and in the accompanying tables. To download the December 2010 Barometer click on the PDF icon.

Unemployment, stuck at the same high rate for three months, edged up even higher. Job growth, though positive, was a far cry from last month’s and even further from what is needed to bring down the jobless rate. Despite these grim figures, retail sales continued to grow and consumer confidence improved for the second-straight month.

October was a dismal month for the housing sector, save for a solid rise in pending home sales. This forward-looking activity allows for a rise in expectations, something no other housing data could manage in October. Both sales and prices for all types of housing slipped, and building permits and housing starts remain at a fraction of their long-term monthly averages. Foreclosure activity dipped, but the decline is expected to be temporary as lenders slow down to review foreclosure documents for potential irregularities.

Commercial property prices rose while sales volume fell. Commercial mortgage–backed securities (CMBS) issuance remains active, while November’s CMBS delinquency rates resumed the upward trend of the past 26 months, interrupted only by a dip in October.

Economy

November was a real mixed bag for the economy. The unemployment rate rose and private sector job growth, while positive, was way down from October’s strong numbers. The S&P 500 monthly returns were almost flat, and inflation barely registered. But retail sales growth continued, and the often-seesawing consumer confidence increased for the second-straight month.

The disappointing net increase of 39,000 jobs in November masks the creation of 50,000 private sector jobs, still a letdown after September’s private sector growth of 160,000 jobs. Declines in October were concentrated in retail, manufacturing, local government, and certain seasonal leisure industries (amusements, gambling, and recreation). Growth was concentrated in health care and temporary help services, with growth also occurring in couriers and messengers, food service and drinking places, and performing arts and spectator sports. The ramp-down of the temporary census work force that has so heavily affected employment figures since May is all but complete.

After holding steady at 9.6 percent for three months, the unemployment rate in November crept up to 9.8 percent as new workers entered the workforce and more unemployed reentered the job market looking for work.

The preliminary estimate of third-quarter 2010 GDP growth was revised upward to 2.5 percent, a welcome increase over the second-quarter GDP growth of 1.7 percent. Still, the rise in third-quarter GDP remains substantially below the first quarter’s growth of 3.7 percent, which inspired hope at that time that the economy was jolting awake; then again, third-quarter growth is approaching the historical average (since 1970) of 2.9 percent, suggesting that reliable, if not exciting, growth may be ahead.

The Consumer Confidence Index rose for the second-straight month, up from 49.9 in October to 54.1 in November, the highest it has been since June. Still, it is only 62 percent of January 2008’s level of 87.3. Retail sales growth has been healthy for four straight months now, with each monthly growth rate above the long-term average of 0.4 percent (since 1992). October’s retail sales grew 1.2 percent. Actual retail sales volume—$373.1 billion—is just now almost back to the pre-recession peak of three years ago ($379.8 billion in November 2007).

Inflation, as measured by the Consumer Price Index, barely changed, increasing by 0.2 percent in October. Ninety percent of this increase was due to increases in gasoline prices. Over the past 12 months, the CPI has risen 1.2 percent.

November’s S&P 500 index saw positive returns for the third-straight month, but only barely, increasing a pitiful 0.1 percent following October’s increase of 3.8 percent. Year-over-year returns are down from September’s 16.5 percent to 9.9 percent as of the end of November and are now below the long-term average of 10.2 percent.

Real Estate Capital Markets

The real estate capital markets remain lackluster and mixed as CMBS delinquency rates rose even as CMBS issuance continued to be active, property sales volumes remained feeble, and REIT returns were negative. Commercial property prices, though still low, showed some upward movement.

The REIT sector saw negative total returns in November of 2.0 percent after two months of solid positive returns. Total returns for the past year remain a healthy 31.0 percent. Total returns for the month by property sector show the highest returns for apartments, 2.2 percent, and the lowest for the office sector, –3.6 percent. The office sector had the lowest returns in October as well, 2.7 percent.

CMBS issuance was active in November for the fourth-straight month, according to Commercial Mortgage Alert, with $2.16 billion total issuance, none of which was a multi-borrower deal. CMBS delinquency rates, according to Trepp LLC, increased to 8.93 percent in November after a dip in October due to resolution of the Extended Stay Hotels loan. September’s delinquency rate was the highest rate in the history of the CMBS industry, and November’s rate is the second highest.

Property sales volumes fell in October to $7.9 billion from $10.5 billion in September, according to Real Capital Analytics, and are now at 51 percent of the monthly average since 2001. This follows four months in a row in which sales volumes were between 60 percent and 67 percent of the historical monthly average.

The Moody’s/REAL Commercial Property Price Index rose 4.3 percent in September, after three straight months of decline. (This index is reported monthly as a three-month moving average, with a two-month lag.) Values are now close to those of a year ago—just 0.3 percent above the September 2009 index—and are at 57 percent of the peak value in October 2007. Green Street Advisors’ Commercial Property Price Index, based on estimates of private market value for REIT portfolios, rose 2.8 percent in September, was unchanged in October, and rose 2.1 percent in November. It is now 21 percent above the index of November 2009 and is at 81 percent of the peak value in August 2007.

Capitalization rates remained fairly steady at 7.36 percent in October, similar to September’s level of 7.33 percent. Cap rates remain above the 6.39 percent of June 2007, but are just below the historical norm of 7.6 percent (since 2001).

As reported in last month’s Barometer, the NCREIF Property Index turned in the third positive quarter in 2010, with total returns of 3.86 percent; total returns for the past year are 5.8 percent. Total returns for the quarter by property sector show the highest returns for apartments, 6.04 percent, and the lowest returns for industrial property, 2.8 percent.

For additional commentary on real estate capital markets, see the Capital Markets section of online Urban Land magazine.

Commercial/Multifamily

(Note: The commentary and data outlined below and in the accompanying table are the same as those presented last month because all the information is taken from quarterly data).

Vacancy and rental rates across all property types were in a stabilizing pattern in the third quarter, continuing a trend seen in the first and second quarters of 2010. With this leveling off, rents are now between 6 percent and 18 percent below their pre-recession peak: apartment rents are down 6 percent from their peak, office rents are down 12 percent, retail rents are down 14 percent, warehouse rents are down 15 percent, and the hotel revenue per available room (RevPAR) index is down 18 percent. Vacancy rates for apartments are just above historical norms, while rates for all other property types remain well above historical norms.

Office vacancy rates stood at 19.5 percent in the third quarter of 2010, about the same as in the second quarter, and just 50 basis points above the rate in the third quarter a year ago, according to Property & Portfolio Research (the source of all data presented in this section). Completions in the third quarter were down as a percentage of inventory, decreasing from 0.2 percent in the first quarter to 0.1 percent; figures for both quarters are substantially below the historical average of 0.7 percent. The absorption of 11.1 million square feet of space continues the positive absorption first seen in the second quarter after nine quarters of negative absorption. Rents remained stable and are off 3.6 percent from the same quarter a year ago.

Retail vacancy rates stood at 18.8 percent in the third quarter of 2010, down slightly from 19.2 percent in the second quarter and just 20 basis points above the figure for the same quarter a year ago. Completions in the third quarter of 2010 as a percentage of inventory were 0.1 percent, the same as in the second quarter and below the 0.6 percent historical average. Rents remained stable in the third quarter and are off 4.0 percent from the same quarter a year ago.

Warehouse vacancy rates stood at 13.1 percent in the third quarter of 2010, down slightly from 13.2 percent in the second quarter and 50 basis points above the figure for the same quarter a year ago. Completions in the third quarter of 2010 stood at 0.1 percent of inventory, up from virtually no activity in the previous quarter and below the 0.6 percent historical average. Rents stayed about the same and are off 5.9 percent from the same quarter a year ago.

Apartment vacancy rates stood at 7.7 percent in the third quarter of 2010, down slightly from the second quarter and 60 basis points below the figure for the same quarter a year ago. Completions in the third quarter of 2010 stood at 0.1 percent of inventory, the same as in the previous quarter and below the 0.4 percent historical average. Rents remained stable in the first quarter and are off just 0.3 percent from the same quarter a year ago.

Hotel occupancy rates (a moving 12-month average) stood at 60.9 percent in the third quarter of 2010, up from 58.4 percent in the same quarter a year ago. Completions were down slightly as a percentage of rooms, from 3.2 percent in third-quarter 2009 to 2.1 percent—now below the historical average of 2.2 percent. The RevPAR Index was up 9.2 percent from the same quarter of 2009.

Housing

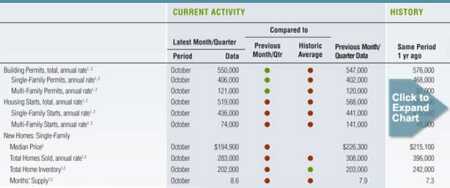

Starts, prices, and sales declined for all types of housing, while building permits barely inched upward. A single bright spot is significant for its forward-looking perspective: the National Association of Realtors’ (NAR) Index of Pending Sales rose 10.4 percent in October from September. It is now about 20.5 percent below the level experienced last October when pending sales peaked in response to the first-time homeowner tax credit. The index at that time approximated the index of May 2006.

Single-family building permits increased 1 percent from 402,000 in September to 406,000 in October; building permit activity in the past four months is at the lowest level since April 2009. Over the past 12 months, monthly single-family permits have bounced between 41 percent and 55 percent of the monthly average (since 1970), with October’s and the three previous months’ permits at 41 percent of the average.

Multifamily building permits increased by 0.8 percent to 121,000 in October, barely reversing the direction of September’s 30 percent decline to 120,000 permits. Over the past 12 months, monthly multifamily permits have bounced between only 23 percent and 38 percent of the monthly average (since 1970), with September’s and October’s permit numbers at 30 percent of the average.

Single-family housing starts fell by 1.1 percent in October to 436,000. October’s starts are at 40 percent of the monthly average (since 1970) for single-family housing starts.

Multifamily housing starts fell by 48 percent, following a 16 percent decline in September. Multifamily housing starts in October stood at 74,000, representing 21 percent of the monthly average (since 1970). October starts were the lowest since February 2010.

Median prices for new homes were down 14 percent in October at $194,900, compared with September’s prices of $226,300. October marked the first time since 2003 that median prices for new homes were below $200,000.

The S&P/Case-Shiller Index for existing home prices notched downward for the second- straight month after four straight months of increases; the September index is now just 0.6 percent higher than it was 12 months earlier. (This index is reported monthly as a three-month moving average, with a two-month lag.) Data from the National Association of Realtors (NAR) showed existing single-family home prices down by 3.2 percent in September and down 0.8 percent in October; prices are now 0.5 percent below where they were in October 2009. Prices of existing condominiums were fairly steady in October, according to NAR, and are 4.2 percent lower than they were last October. Housing affordability remains near historical highs.

The number of existing single-family home sales (seasonally adjusted) decreased by 2 percent to 3.89 million in October. Despite solid increases in August and September, sales of existing homes in each of the past three months were at lows not seen since 1997; monthly supply did not change in October and remains at 10.1 months. Existing condo sales fell 3.6 percent to 540,000, and monthly supply stepped down slightly from 14.0 months to 13.4 months. Sales of new single-family homes decreased 8 percent to 283,000 in October and supply increased from 7.9 months to 8.6 months. Monthly sales of new single-family homes since May have been at levels not seen since record keeping began in 1963.

Foreclosure filings—default notices, scheduled auctions, and bank repossessions—decreased 4.4 percent in October from a month earlier to 332,172 filings, according to RealtyTrac. The largest decline, 9 percent, was in bank repossessions. A decrease was expected as banks slowed or halted their foreclosure process to correct any irregularities in foreclosure documents. Still, RealtyTrac notes that October was the 20th-consecutive month in which over 300,000 households received a foreclosure notice.

Home mortgage rates (30-year fixed) remained very low—4.30 percent in November—but have edged up slightly since then.