When Chicago’s OneEleven apartment development sold for a record price earlier this year, it marked the second notable achievement for the project. Before the $328 million sale, mere completion of the 60-story building had erased an eyesore from one of the Loop’s most visible walls of trophy towers.

Chicago-based real estate investment management firm Heitman paid $651,000 per unit for the building along the Chicago River, a city record. That January sale by Related Midwest is even more remarkable considering that just a few years earlier, the property at Wacker Drive and Clark Street stood as a constant reminder of a real estate development pipeline that had dried up during the recession.

From 2008 to 2012, a 27-story concrete skeleton lurked over office workers and tourists walking along the Chicago River. A previous developer’s plan to construct the city’s fifth-tallest skyscraper—90 stories of luxury condominiums and a hotel—was halted after efforts to secure a construction loan stalled.

“It was a pretty palpable sign of the downturn,” says Curt Bailey, president of Related Midwest, an affiliate of New York City–based Related Companies.

“It basically said, ‘The city is not viable for development, and we’ve got failure on our face.’ The architecture boat tours go right by there, and they were basically staring at it.”

Nine years elapsed between the ground breaking by the initial development venture, an affiliate of Chicago-based engineering firm Teng & Associates, and the record sale by Related. The unusually long time it took to complete the redesigned 504-unit project likely contributed to its eventual success, with the final deal highlighting just how much the downtown residential market had changed during that time.

“It was the wrong product at the wrong location at the wrong price point at the wrong time,” Gail Lissner, vice president at Chicago-based real estate consulting firm Appraisal Research Counselors, says of early efforts. “At the time, there was very little residential development south of the Chicago River in the Loop. It wasn’t a proven location for ultraluxury at the time. Now, it’s a very different location today, much stronger as a residential location.”

Teng executives kicked off the planned 90-story Waterview Tower and Shangri-La Hotel—which was to include 233 condos and 200 luxury hotel rooms—in early 2006. Work started before construction financing was secured, and in early 2007 Chicago-based LaSalle Bank provided a $20 million bridge loan.

A Chinese bank agreed to provide $400 million in construction financing, but those plans were halted in 2008 as the lending markets froze amid a swooning economy. Work stopped in summer 2008, and the following March, Hong Kong–based Shangri-La Hotels and Resorts announced it was pulling out of the project.

That same year, Charlotte, North Carolina–based Bank of America, which acquired LaSalle Bank, sued to foreclose on the bridge loan. Contractors filed liens on the property for unpaid work, further snarling the project. Following the advice of a local developer who was not involved in the project, the lien holders eventually formed a group to seek a developer that could resume the project.

“We were told, ‘You might be able to make something out of this if a developer is only dealing with one group rather than 25 or 30 separate contractors,’” says the leader of the group, Michael Hughes, chairman of Broadview, Illinois–based Huen Electric, which was owed more than $8 million.

After talking with several potential developers and hearing proposals for a wide range of possible uses for the shell, the group chose to go with Related, which had experience with large, complicated developments as well as access to equity to relaunch the project. Related also offered a slice of an eventual sale, creating a profit for lien holders, Hughes says.

“At one time, if the building was just used as its original design, it was a matter of whether you were going to get 25 cents on the dollar, 50 cents on the dollar, or 75 cents on the dollar,” Hughes says. “Related put together what you’d call a grand slam.”

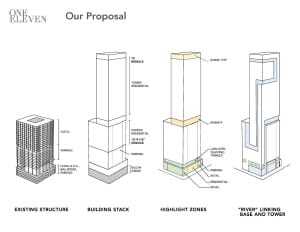

Related took control of the site in 2011 and began reorganizing the tower’s design. The firm held its own ground-breaking ceremony in November 2012, high above the ground and featuring sledgehammers rather than shovels.

“We were very certain that if we delivered our product at that location, it would lease up at great rates,” Bailey says. “We were concerned on the construction side, because you’re taking a structure that’s been sitting there for [four] years. That was the thing we worried about the most, but it was as good as the day it was born. That was a huge moment for us.”

Existing floors, which had already been laid out as hotel rooms, were converted to smaller apartment units, or in some cases multiple hotel rooms were combined. On higher floors, a triangular design was scrapped for a more efficient rectangle, which also brought those floors six to eight feet (1.8 to 2.4 m) closer to Wacker Drive and maximized views of the river.

“I’ve never seen anything in this country like this before,” says Gary Handel, principal at New York City–based Handel Architects, who redesigned the building. “It was a great design challenge to take the existing structure and repurpose it for something completely different. We calculated that we saved 40,000 cubic yards [30,600 cu m] of concrete from being dumped into a landfill.”

Workers chopped off the top one-and-one-half floors of the existing 27-story structure and added an amenities floor with 26-foot (8 m) ceilings and floor-to-ceiling windows to serve as a transition between the old portion and the new portion above. An unusually thick concrete slab was added above the newly created floor onto which the remainder of the project could be constructed.

“Instead of just going up from the bottom, we were basically building two buildings at once,” Bailey says.

Related’s vision for the project coincided with an improving economy and rising demand for downtown apartments, both by renters and investors. OneEleven also received a lift from the emergence of River North—the area just across the river long known for dining and nightlife—as the center of Chicago’s growing technology sector. The sprawling Merchandise Mart, on the opposite bank of the river, has recently added thousands of office workers—2,000 from Motorola Mobility alone after then-owner Google moved the phone maker there from suburban Libertyville last year.

“It’s indicative of the change that’s going on in Chicago and other strong American cities in terms of being a place to live and work in the heart of these great downtowns,” Handel says.

Related, which financed the $180 million project with a $115 million construction loan, opened the tower in July 2014. As of the first quarter of 2015, OneEleven had the highest rents in the city, at nearly $4 per square foot, according to Appraisal Research Counselors. The 950,000-square-foot (88,000 sq m) building includes a 470-space parking garage.

“They were able to take the shell and convert it to a design that was very much in line with where market demand is today,” Lissner says. “They made it a product that wasn’t 2,300 square feet [214 sq m] on average. Instead, it’s 900 square feet [84 sq m]. It’s just a combination of timing and a well-executed development plan.”

The new owner Heitman, through a spokeswoman, declined to comment on the property.

Related, meanwhile, is focusing on another body of water for its next reclamation project in Chicago: Lake Michigan. In November 2014, the firm took control of the former Chicago Spire site along Lakeshore Drive where Irish firm Shelbourne Development Group once planned a 150-story residential building. But construction of the twisting, 2,000-foot-tall (610 m) tower designed by Spanish architect Santiago Calatrava stalled soon after it started in 2007. Shelbourne was forced into bankruptcy in 2013, with unpaid bills of more than $100 million.

Related has yet to unveil its plans for the 2.2-acre (0.9 ha) site just west of the lake. Today, a 76-foot-deep (23 m) hole is the only reminder of what would have been the tallest building in the Western Hemisphere.

Ryan Ori covers commercial real estate for Crain’s Chicago Business.