This article was written by Peter Burley and David Lynn, two of the contributors to ULI’s textbook, The Investor’s Guide to Commercial Real Estate.

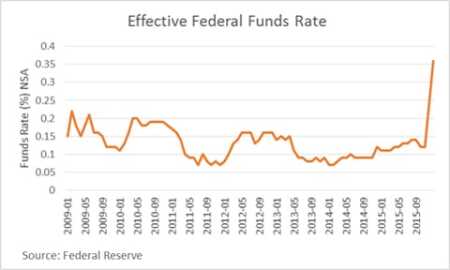

The U.S. property market landscape in 2016 will appear much like it did in 2015, with a number of interwoven aspects that bode well for savvy investors who can step out in front of ongoing—and, in some cases, intensifying—economic, demographic, and technological trends. On the economic side, the U.S. Federal Reserve made it clear in December that the central bank sees U.S. growth as relatively stable when the federal funds rate was notched higher by a quarter point. Nevertheless, underlying inflation is extremely tame (with worries of deflation in some sectors and economies) in the United States and major emerging markets, providing no impetus for significantly higher rates. That may put some pressure on other global economies, including the Eurozone and China, but will also make U.S. assets more attractive in the coming year.

Related: Six Trends to Watch for 2015

Most economists agree that the U.S. employment situation will remain on its current trajectory, with unemployment falling below 5 percent early in the coming year, adding to demand for housing in a variety of forms, for office space, for the retail sector, and for industrial/distribution. Demographic shifts that have been underway will continue, as millennials find jobs, form their own households, and either buy or rent their first homes. Baby boomers will continue to retire at the current rate of about 10,000 per day and to downsize their homes and move either to walkable urban communities or into senior housing. Technology will continue to change the landscape in numerous ways—from the way people shop to the way they work to the way they interact with their surroundings. Some trends loom larger as one looks ahead. Inspired by our conversations among colleagues, including several members of the Counselors of Real Estate (who produce the widely read annual Top Ten Issues Affecting Real Estate), the following are six trends that we believe will play a significant role in commercial real estate in the upcoming year.

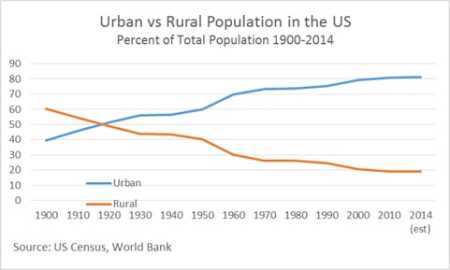

1. The global urbanization trend continues in the United States, as it does elsewhere, as boomers and millennials seek enhanced access to jobs and amenities—from shopping to entertainment to health care. The U.S. urban population increased by 12.1 percent from 2000 to 2010, according to the U.S. Census, outpacing the nation’s overall growth rate of 9.7 percent during that same ten-year period. That trend continues. Even suburban communities are taking on more of an urban form, with mixed-use development and public transportation options—and limited automobile dependence—creating higher densities and more of an “urban” feel. While the trend toward urbanization continues, it creates enormous demand for housing, retail, office, and other property sectors.

2. Interest rates will be on the rise—for sure this time—as the Fed move in December demonstrated. Forecasts vary, but the likelihood is that the Federal Funds Rate rises at least to, or above, 1.0 in 2016, with ten-year Treasuries pushing fractionally higher toward the 3 percent mark. A number of factors are keeping rates low for now, including limited inflation due to soft energy and import prices and the strong dollar. Furthermore, the Fed is more than likely to weigh the effects of each move it makes before adding any additional friction to current (if unspectacular) economic growth trends. The squeeze on cap-rate spreads becomes a real concern for some investments, especially as “frothiness” in some gateway, Class A markets emerges (see our cautionary note from early 2015). At present, little indication exists that the first rate increase will push cap rates dramatically higher. Nonetheless, there are indications that yields will likely begin to drift upward as a result of further rate increases. And, as pricing in first-tier markets stalls and yields hover in the sub–4 percent range in some of the major gateway markets—which are, in some cases, already in dicey territory—we should probably expect investors to move more aggressively into secondary and tertiary markets—and to opportunities beyond core assets to core-plus and value-add properties as well as some of the niche property sectors, including medical office, student and senior housing, and data centers.

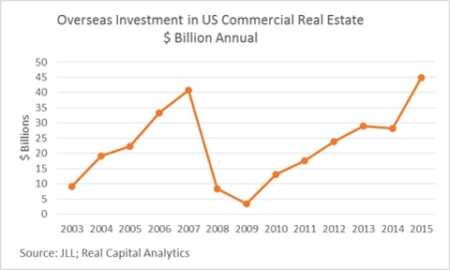

3. International capital flows into U.S. real estate assets will continue—and increase. Global economic and political uncertainty continues to drive capital to a “safe haven” in the United States. The U.S. property market is the most stable and transparent in the world, making it an easy investment choice. And, while slowing growth in China and much of Europe may dampen currencies and incomes over there, there is still abundant non-U.S. capital looking for placement and still very high demand for U.S. assets, as 2015 proved with record inflows. In 2015, foreign purchases of U.S. real estate assets rose to $62 billion over the 12 months ending in October, according to Real Capital Analytics, with Canada, Norway, Singapore, and China all leading the wave. Among members of the Association of Foreign Investors in Real Estate (AFIRE), a substantial proportion expect to increase investment in the United States in 2016.

4. There will be continued stress on retail and continued retail shifts—including mixed (virtual/physical) spaces and entertainment-themed spaces. The economy is still putting pressure on spending anyway, but with interest rates rising, consumers will be paying more to use their credit cards, the result being somewhat more discernment in how they spend, offset perhaps slightly by an anticipated windfall in energy prices (see #6, below). The technology of retail continues to evolve as well. During the 2015 Thanksgiving shopping weekend, online purchases actually outpaced in-store purchases for the first time. Analysts suspect that the more successful retailers will be those that can optimize a combination of virtual online and physical in-store shopping experiences. Amazon has begun to explore physical shopping spaces in combination with its wildly successful online model by opening its first physical store in Seattle this past fall (ironically, in a former Barnes & Noble location). It would not be a surprise to find physical retailers pushing similar formats in the other direction—including more “showroom”-styled storefronts with digital spaces offering fulfillment. (Some retailers should probably seek out hospice care. Our guess is that, in its 130th year, Sears could finally succumb in 2016, with some of its brands, like Craftsman and Kenmore, being spun off to something or someone else. JCPenney is being squeezed by competition from the lower-end Kohl’s and Marshalls and from the higher-end Macy’s as well.)

5. Additions to supply will continue to be limited, with only modest supply growth in a few sectors—multifamily (peaking, then slowing slightly late in 2016), student and senior housing (creeping up), and single-tenant industrial (regional/nodal distribution centers)—and repurposing in others (suburban malls and those abandoned Sears and KMart stores). Lending sources were extremely skeptical about funding new construction coming out of the last recession. The Great Recession was deep and protracted, and many local and regional banks had gotten hit by the residential mortgage crisis. Real estate, both residential and commercial, became to be seen as a highly risky sector. Many lenders left the commercial real estate construction and development lending business altogether. Of all the property sectors, only multifamily can be said to be near long-term supply levels.

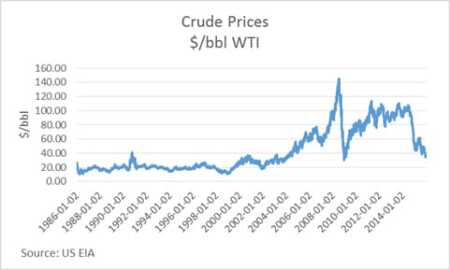

6. Last year saw a dramatic drop in oil prices. Increased production and reduced demand due to slowing emerging-market growth have led to a drop in oil prices from $110 per barrel to under $50 per barrel. The world is oversupplied, and major oil-producing countries have not reduced. This has had a profound economic impact and carries with it implications for property market fundamentals and commercial real estate pricing.

The impacts will vary considerably by region and sector. Negative effects are largely concentrated in a few metropolitan areas with high economic exposure to the energy industries. For most metro areas and property types, lower oil prices have been a net positive. Spending less on gasoline encourages consumers to spend more on other items, which may help retail and hotel market fundamentals. Lower oil and energy costs will also reduce certain construction, manufacturing, and logistics costs. This aids business investment and expansion, which, in turn, increases demand for industrial and manufacturing space.

Property markets will see a short-term lift due to a combination of improving tenant fundamentals and lower operating costs. However, for major energy-producing metro areas, the short-term benefits of low prices will be discounted by the negative impacts on energy-related firms. The long-term health of the property markets in these metro areas will greatly depend on the speed in which oil prices rebound to sustainable levels for U.S. producers. The national economy overall is better off in the near term. The United States is still a net importer of oil at about $190 billion per year, and the decline in prices positively influences the nation’s trade balance. Lower prices directly translate into an increase in household disposable income. Americans could see $50 billion to $75 billion ($400 to $650 per household) in gasoline savings this year alone. The impact on property market fundamentals will vary by sector:

Office. Office demand is not likely to see an immediate positive impact on lower energy costs, but lower operational expenses will make office occupancy less expensive and contribute to higher corporate operating profits, which should in turn continue to fuel hiring and take-up of additional space.

Retail. Households typically spend windfalls. Retailers are reporting above-average, and better-than-expected, holiday sales. Shopping centers and neighborhood shopping centers should benefit.

Industrial. The reduction of energy costs will boost industrial production and reduce distribution costs. Petroleum-based products will benefit from lower input costs, which in turn might positively influence manufacturers’ decisions to increase production and occupancy. Demand for warehouse and distribution space should see an increase because of higher consumer spending. E-commerce operations will expand because of additional consumer dollars, likely resulting in more distribution and storage space.

Hospitality. Hotels will benefit as leisure travelers find it more affordable to drive to holiday destinations. Lower oil prices should result in lower business travel costs, encouraging more business travel and lodging.

Apartments. Increased disposable income means that households will have more to spend on housing, including upgrading to higher-quality apartments. Also, apartments further out in the suburbs will benefit with the lower cost of commuting.

This article was written by Peter Burley and David Lynn, two of the contributors to ULI’s textbook, The Investor’s Guide to Commercial Real Estate.