Alternative lenders increased their market share in the commercial real estate debt sector in 2018, panelists said at a ULI North Texas eventin March. That trend is likely to continue this year as competition among all types of debt providers heats up capital markets.

More than 100 debt funds are operating in the United States today, and they continue to gain market share, said Mona Carlton, senior managing director at HFF.

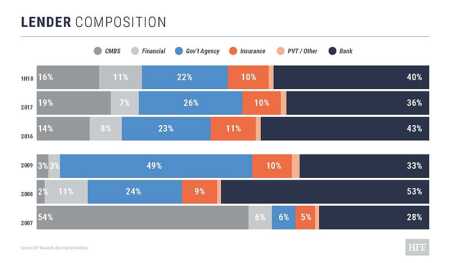

Real Capital Analytics (RCA) reports that debt funds and nonbank lenders commanded about 11 percent of the U.S. commercial and multifamily real estate debt market last year, up from 7 percent in 2017. Banks still command the lion’s share of commercial real estate debt market, at 40 percent in 2018, followed by government-sponsored enterprises, 22 percent; commercial mortgage–backed securities, 16 percent; and life insurance companies, 10 percent.

Kelli Carhart, vice president, production and sales, for Freddie Mac’s multifamily division, said her organization’s book of business has posted strong numbers for the past several years, but that is starting to moderate.

Freddie Mac set a record for multifamily production in 2018 with $78 billion in loan purchase and guarantee volume, besting its previous record of $73.2 billion, set in 2017. The government-sponsored enterprise financed 860,000 rental units last year, with over 90 percent of those in the multifamily sector’s affordable segment.“We think this year we will be flat to up about 3 percent [on loan volume],” Carhart said. Some previously funded projects are taking longer to stabilize than was originally forecast, she said.

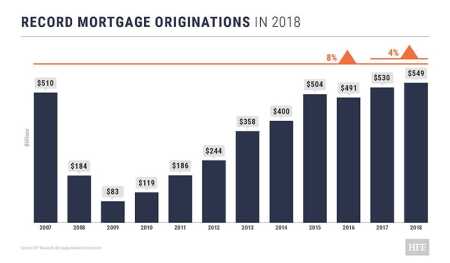

The Mortgage Bankers Association (MBA) forecasts total commercial/multifamily originations in 2019 to be on par with what the market saw last year.

Joe Griffith, managing director at JPMorgan Chase, said 2012 through 2017 were record years for commercial real estate loan origination at the bank, but commercial originations began to drop off last year. Griffith expects more slowing this year, although he said the market will still be healthy.

The reasons for declining lending volume are varied, he said, and include the challenges of rising labor and construction costs, coupled with slowing absorption across product types as some Texas markets deal with significant supply coming on line. On the plus side, job growth still looks good across the state’s major cities, including Dallas, he said.

Dallas ranked third behind Manhattan and Los Angeles for capital flows into commercial real estate construction in 2018, according to RCA, while Houston ranked seventh and Austin 15th.

For Northwestern Mutual and other life companies, business in the commercial real estate sector has remained relatively steady over the past few years, said Kevin Westra, the firm’s director of real estate. Northwestern has issued $5 billion to $6 billion in debt and $1 billion to $2 billion annually into commercial real estate, he said.

“It seems like all life companies have done about the same amount of business the last three years,” Westra said. Life companies may be looking to increase yield going forward, he said. Northwestern, for example, recently did its first mezzanine loan, and Westra noted that some life companies are exploring starting debt funds.

Status of the Market

Commercial property acquisitions dropped 31 percent in January from the same period a year earlier, according to RCA, but instead of a dire warning of things to come, the pause was likely connected to financial turmoil in the stock markets in late December.

According to MBA’s 2019 Commercial Real Estate Finance Outlook Survey, more than half of the top commercial/multifamily firms (55 percent) expect originations to increase in 2019, with 13 percent expecting an overall increase of 5 percent or more across the entire market.

Those surveyed by the MBA also said they expect the greatest growth in commercial real estate originations to come from alternative lenders, such as debt funds.

Lance Wright, managing director of private debt fund ACORE Capital, described the debt space as “really frothy.” ACORE, which he said is capitalized with equity from Japanese life companies, began business in 2015 with only a handful of people. Today it employs 75 people in several offices, Wright said. The debt fund focuses on transitional projects, including value-add deals and adaptive use projects. Its loans range from about $30 million to over $300 million.

About 75 percent of the deals it funds are acquisitions, but ACORE is seeing investors approach the debt fund market for refinances if they did not get the sales price they were seeking, he said.

None of the panelists expressed concern about a recession in the near term, but some noted preparations for that eventuality are underway.

“We don’t forecast a recession, but we are prepared for it,” said Griffith. “We are thinking of things we need to do to prepare for the down cycle.”

Wright noted that 2020 is a presidential election year, which could bring big changes to the commercial real estate market.