News

The ULI Terwilliger Center for Housing has announced two winners for the 2023 Jack Kemp Excellence in Affordable and Workforce Housing Award and four winners for the 2023 Terwilliger Center Award for Innovation in Attainable Housing.

The ULI Terwilliger Center for Housing has selected the City of Tallahassee, Florida, as the winner of the 2023 ULI Robert C. Larson Housing Policy Leadership Award. The award was created in 2011 to honor the legacy of the late Robert C. Larson, a former ULI Foundation chairman and longtime ULI trustee.

ULI and Heitman released a report today highlighting how investors may leverage the data resulting from government regulations that require real estate companies to disclose climate-related risks related to their properties and overall business models.

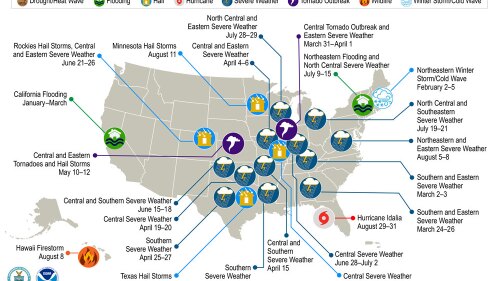

According to the National Oceanographic and Atmospheric Administration, there have been 23 confirmed weather/climate disaster events with losses exceeding $1 billion each to affect United States in 2023.

At the 2023 ULI Spring Meeting in Toronto, the Emerging Trends in Real Estate® session, hosted by the Institute’s University Connections program, shed light on younger generation’s perceptions of suburbs and the shifting preferences of students when it comes to choosing where to live and work post-graduation.

ULI visiting fellow Yvonne Yeung, who authored Building 15-Minute Communities: A Leadership Guide, recently appeared on the Talking Headways podcast. She chatted about how the guide can help create good development that reduces the need to drive, and supports climate emissions reduction goals.

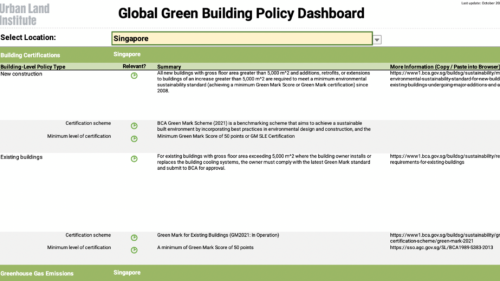

ULI Greenprint partnered with ARUP to develop a Global Green Building Policy Dashboard that allows real estate practitioners to filter by location and see a summary of key requirements related to building certifications, greenhouse gas emissions, embodied carbon, energy, electric vehicles, renewable energy, and resilience.

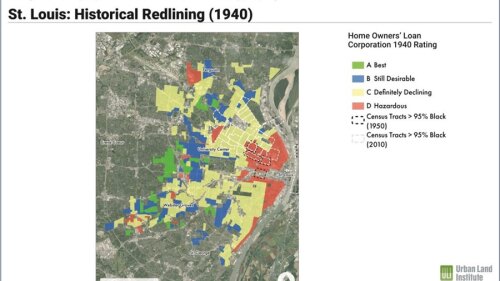

In St. Louis, a pressing home repair crisis is disproportionately affecting Black homeowners who struggle to afford the upkeep of their homes. This issue is deeply rooted in a legacy of racial injustice, including redlining and restrictive covenants. To find solutions, ULI St. Louis collaborated with local organizations to develop strategies aimed at establishing a Home Repair Network, which will create a new centralized umbrella organization to address the city’s home repair dilemma.

New U.S. home sales among the 50 top-selling master-planned communities increased by 7 percent compared with the pace set by the top communities in the first half of 2022

In 2020, Mahlon “Sandy” Apgar, a ULI trustee and Julia Morgan Society member, provided an endowment to the ULI Foundation to create the ULI Apgar Thought Leader Award. The award program encourages the sharing of original research and innovative ideas related to the real estate industry. Every two years, a committee chooses a winning article published in Urban Landmagazine and written by a thought leader, awarding a $1,500 honorarium and free registration for the Institute’s Fall or Spring Meeting.