Stakeholders across the real estate value chain are increasingly recognizing that the climate crisis and biodiversity loss are deeply interlinked, and one issue cannot be solved without addressing the other. However, solutions are ready and available for real estate to implement today, according to a new report out of ULI’s Greenprint Center for Building Performance: Nature Positive and Net Zero: The Ecology of Real Estate, sponsored by Jacobs.

The real estate industry has a large impact on land use both within and outside urban environments but has not often considered biodiversity or ecosystem services as part of its business or climate strategy.

However, restoring and preserving natural systems are key to resilient and sustainable real estate, protecting material supply chains and preserving building value, while also achieving ambitious net zero carbon goals.

What Does Nature-Positive Development Mean?

A nature-positive perspective is not just about conserving existing biodiversity in land use planning and development but is also about seeking to enhance or restore natural functions and species richness to a site.

Nature-positive development in its fullest expression would ensure that any given development is as ecologically functional “as the wildlands next door” in supporting local species and their ecosystem needs, according to Nicole Miller, managing director of the bio-inspired consultancy Biomimicry 3.8. “Nature is our only successful model for regenerative impact.”

What’s the Business Case?

Progress towards integrating nature has been significantly driven by increased investor interest, as Darryl Stuckey with Lendlease notes: “The investor space is pretty active in asking us what we’re doing on biodiversity. The conversation has turned from, ‘What are you doing in the carbon space?’ to ‘What are you doing in the biodiversity space?’ That’s obviously putting us in a position where we need to be on our front foot.”

Coupled with a clear payback on property value from occupant demand, increased community and regulatory support, reduced operating costs, and increased climate resilience, nature-positive real estate presents a strong business case. Andy Bush with Morgan Creek Ventures describes how, “During the COVID-19 pandemic, people came to appreciate the value of open space and views, and a place to step out on a porch and get fresh air. There’s a renewed interest by people to experience biodiversity—they may not know exactly what they’re experiencing or use the term biodiversity to describe it, but they appreciate it and see it. All of those for us help improve our long-term return.”

Four Scales of Action for Real Estate

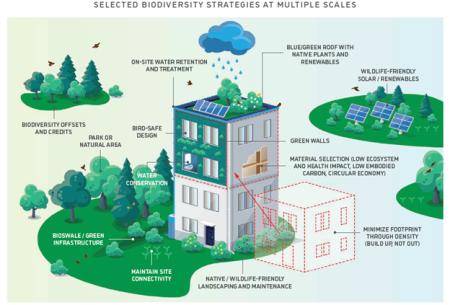

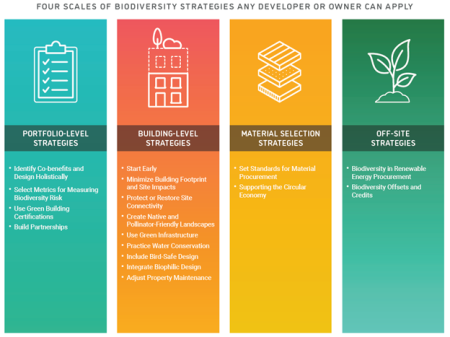

Based on interviews with developers, designers, non-profits, and ecosystem engineers, Nature Positive and Net Zero found that real estate can act to preserve or restore biodiversity and ecosystem services at four scales:

Read on to discover how leading companies are implementing nature-positive real estate at each scale.

Portfolio-level strategies: identify co-benefits and design holistically

While occasionally considered during risk assessment for new investments in the past, biodiversity is increasingly embedded in an organization’s sustainability strategy. By obtaining senior leadership buy-in and setting expectations from the start, organizations are better able to set baselines for biodiversity in a project, identify opportunities, and integrate nature from the start of a project, when costs are lowest and the potential impact highest.

For example, Lendlease, a global property and investment group, aims to maximize the co-benefits of nature-positive investments, including a number of projects with living shorelines. At Clippership Wharf in Boston, Massachusetts, redevelopment of the historic property provides public access to the waterfront for the first time in more than 25 years. In addition to achieving LEED Silver certification for Neighborhood Development, the living shoreline incorporates native plantings and wave dissipating features. Other shoreline mitigation measures include the stabilization of existing seawalls, new wetland resource areas, rain gardens, and bioswales, as well as the update of neighborhood stormwater infrastructure. The development itself is elevated to account for future sea-level rise. In addition, activity and educational programs were developed to engage the community and support public open space.

Building-level strategies: use green infrastructure

Holistic design and operations considerations can yield positive ecosystem services and regenerative ecosystems at the building level – for instance, through green infrastructure.

District House, a 75,000-square-foot (6,967.7 sq m) mixed-used development incorporating mid-rise condominiums and ground-floor retail in Oak Park, Illinois, exemplifies how green infrastructure can add value, biodiversity, and resilience to any building.

Lawned terraces on one floor and a wildflower meadow on the roof connect tenants to nature while providing the developer with a strong return on investment. Aiming to manage 100 percent of stormwater on site, the lawned terrace has a retention capacity of over 8,250 gallons (3,1230 L) of stormwater while the rooftop space can store over 21,000 gallons (79,494 L).

The green roof extends the building life cycle by reducing exposure to ultraviolet radiation and extreme temperatures while providing thermal insulation. Building units with the lawned terraces sold for an average price 12.4 percent higher than similar units without terraces on higher floors, for an average premium of roughly $95,000 per unit.

Material Selection Strategies: Support the Circular Economy

The principles of the circular economy can support biodiversity preservation by eliminating waste and reducing pollution, reusing products and reducing resource extraction, and ultimately regenerating nature.

ABN AMRO Bank’s approximately 30,000-square-foot (2,787 sq m) Circl Pavilion in heart of the Zuidas business district of Amsterdam shows the power of designing for circularity through a building’s entire life cycle.

On the ground floor, a collection of hardwood taken from a former monastery and the bar of Dutch football club Top Oss was used to make the floor. The partition walls for the basement conference rooms came from the facade of another building. The insulating material in the ceilings is made from 16,000 old pairs of jeans (collected from ABN AMRO employees). The plastered walls and the felt on the stands contain old work clothing of ABN AMRO’s retail employees.

Most importantly, Circl was designed so that when the building is eventually taken down, these high-quality materials can be reused. This approach creates additional value by treating the buildings as a raw materials bank. By reducing the total amount of materials by a third from the original design, Circl also avoided a considerable amount of embodied carbon emissions.

Off-Site Strategies: Biodiversity Offsets and Credits

Biodiversity offsets, similar to carbon offsets, aim to create measurable increases in nature outside the project area to compensate for the negative impacts of a project.

Biodiversity credits are distinct from offsets in that they are not meant to compensate for harmful biodiversity impacts at a 1:1 ratio. Instead, the World Economic Forum defines voluntary biodiversity credits as a proactive “investment in nature’s recovery, rather than an offset for damage,” through the creation and sale of biodiversity units anywhere in the world.

Biodiversity credits are an emerging strategy. According to the Forum, in May 2022, ClimateTrade, a ‘blockchain-based climate marketplace’, and Terrasos, a Latin American conservation organization, launched a new credit project – the first issue of which came from the Bosque de Niebla-El Globo Habitat Bank (the Spectacled Bear Habitat Bank).

These credits work to protect a cloud forest habitat that hosts threatened species such as the spectacled bear, the yellow-eared parrot and the black-and-chestnut eagle. Each $30 credit from the project purchases 30 years of conservation and/or restoration of 10 square meters of the forest.