The ULI Responsible Property Investment Council (RPIC) in January kicked off a webinar series that will run through 2018 highlighting the business case for renewable energy investments in real estate.

The inaugural webinar in the series focused on responsible property investment and the business case for sustainability, “Here Comes the Sun,” provided an in-depth look at the project economics of a pilot solar retrofit project developed by Ginkgo Residential, a development and property management company operating in southern Virginia and the Carolinas.

The project, a retrofit of the Aurora Apartments, a 420-unit complex in Charlotte, North Carolina, had a projected payback of 9.7 years, said Philip Payne, chief executive officer of Ginkgo. The investment in solar power made sense because the projected return on investment (ROI) was over 10 percent and the projected immediate impact on the net present value of the property was $150,000, compared with a net cost of $87,500.

“In real estate we are about creating value, and it’s hard to argue with the value created with this solar project,” Payne said during the webinar.

Though the project encountered some hurdles, primarily in utility permitting, both the owners and tenants are pleased with the result, he said. The solar array provides more electricity than needed to power the fitness center and leasing office, as well as half the electricity needed for the pool.

Current and prospective renters are excited to have renewable energy helping power their apartment complex, he said. Ginkgo is already planning to execute additional solar retrofits on its other local properties.

The utility required that some of the power production be shifted from the pool to the leasing office, meaning that the project is not hitting its projections, Payne said. Instead, the ROI is likely to be between 7.8 and 9.6 percent, the increase in current value between $113,000 and $140,000, and the payback period between 10.4 and 12.9 years. Ginkgo is exploring ways to use the excess power or sell it to maximize the value of the system.

Despite the project falling short of its goals, Payne said his company has learned from its mistakes and believes that returns similar to its original projections will be achievable in future projects.

Investment in the solar panels was analyzed in the same manner as other improvements, said Stuart Mackintosh, managing director of direct real estate at EII Realty Corp., an investor in the project. “Solar, like any other property investment, had to exceed an ROI hurdle rate of 8 percent,” he said during the webinar. “Otherwise, they [the investor group] would not make the investment.”

EII has found that some of the best returns in rehab projects can be found in energy efficiency, Mackintosh said. “Adding additional insulation and retrofitting older lighting to LED can achieve an annual ROI over 20 percent,” he said. “Upgrading HVAC equipment and older appliances to Energy Star can achieve ROIs in the 10 percent range or better.”

Like Ginkgo, EII Realty is interested in exploring more solar project opportunities, provided they can meet the company’s investment hurdle rate.

The “Here Comes the Sun” webinar was the first in a six-webinar series being developed by the RPIC for this year. A full recording of the webinar is available here.

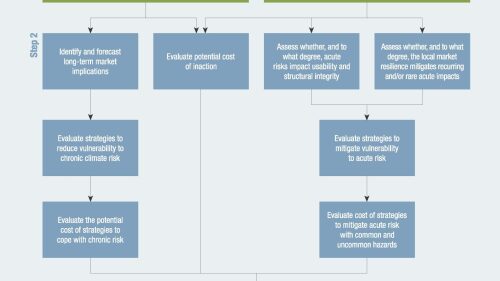

Future topics include the business case for sustainability from the institutional investment community; technology and real estate, including artificial intelligence and robotics; the intersection of climate change, resilience, and investment; new tools for sustainability finance; and private capital solutions in affordable housing and homelessness.

The next webinar, entitled “Sustainability and Social Responsibility in 2018 and Beyond: What International Investors Expect in Responsible Property Investment” will be held March 27, 2018, at 1:00 p.m. EST. Click here to register for this webinar.