Demand for units outpaces decelerating new supply, fueling occupancy gains.

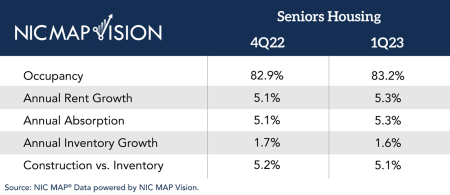

The senior housing occupancy rate increased 0.3 percentage points from 82.9 percent in the fourth quarter of 2022 to 83.2 percent in the first quarter of 2023, according to data from NIC MAP Vision released by the National Investment Center for Seniors Housing & Care (NIC). The occupancy rate has increased 5.4 percentage points overall from a pandemic low of 77.8 percent in the second quarter of 2021 but remained 4.0 percentage points below the pre-pandemic high of 87.2 percent in the first quarter of 2020.

This represents the seventh consecutive quarterly occupancy rate increase, as a slowdown in inventory growth—0.3 percent from the prior quarter and 1.6 percent year-over-year, near the lowest year-over-year increase in inventory growth since 2013—is helping occupancy rates recover.

“The continued increase in senior housing occupancy rates was driven by positive net absorption coupled with limited new supply,” said Chuck Harry, NIC’s chief operating officer. “The likely ongoing recovery in senior housing fundamentals is further supported by the first quarter’s lowest rate of senior housing construction since 2014. And construction is expected to remain suppressed during this period of significantly higher financing costs.”

Senior housing units under construction relative to the total existing senior housing inventory continued to trend lower in the first quarter of 2023 to 5.1 percent, down 2.7 percentage points from its historical peak of 7.8 percent in the fourth quarter of 2019. This is the lowest rate of construction since 2014 and is due largely to higher interest rates and a slowdown in financing.

“The increase in occupancy and rate growth should help to drive revenue growth, which may help senior housing properties offset some of the increased expenses related to higher costs of debt, labor, food, and energy that have affected the industry in recent years,” said Caroline Clapp, NIC’s senior principal, Research & Analytics. “The steady improvement in market fundamentals against a backdrop of significant volatility in other parts of the economy illustrates the needs-driven demand for housing and care for older adults that the industry continues to meet.”

The assisted living occupancy rate improved 0.7 percentage points from the prior quarter to 81.2 percent, while independent living remained flat at 85.2 percent. From its pandemic-related low, the occupancy rate for assisted living increased 7.3 percentage points, or 3.8 percentage points more than independent living, which was up 3.5 percentage points from its pandemic-related low.

Dallas (84.8 percent) and San Antonio (84.4 percent) were the only markets from the 31 metropolitan areas that comprise the NIC MAP Primary Markets that have fully recovered and exceeded pre-pandemic senior housing occupancy rates. At quarter-end, Boston (89.1 percent), Portland, OR (86.6 percent), and Baltimore (86.3 percent) had the highest occupancy rates, while Houston (78.5 percent), Cleveland (79.5 percent), and Atlanta (80.3 percent) had the lowest.