Lessons from the Great Recession Are Driving Firms’ Actions Now

While the COVID-19 pandemic and ensuing recession have spurred ULI members to act quickly to adjust their business practices, a significant number of respondents to an Urban Land reader poll say they expect the real estate business to do better during this recession than during the Great Recession of 2007–2009. And a strong majority—about 65 percent—see opportunities for growth.

The online poll, conducted in August, drew 669 responses, all from ULI members in the Americas. Just over 88 percent were from the United States and nearly 7 percent from Canada. The remainder were from Mexico and several countries in Central and South America. At 25 percent of respondents, developers accounted for the largest share. Architects or other design professionals were the second-largest group, accounting for 22 percent of responses.

Most respondents said they see the current economic environment as challenging—31 percent calling it “very” challenging and an additional 10 percent calling it “extremely” challenging. But another 42 percent called the situation only “moderately” challenging.

Respondents were split regarding how current economic conditions will unfold over the next two years compared with the Great Recession. Some 43 percent said they expect the economy to fare better than during that downturn. But more than half hold a more somber view: 36 percent said they expect the current experience to be worse, and 20 percent said they expect the downturns to be similar.

More of the respondents were optimistic when asked specifically about prospects for the real estate sector. Some 54 percent said they expect the sector to fare better than it did during the Great Recession. Twenty-four percent expect it to perform similarly, and 23 percent expect it to perform worse.

More than half the respondents, 57 percent, said some plans have been placed on hold or canceled. Among those respondents, 65 percent said they expect the projects to resume over the next two years, but 9 percent do not. Twenty-six percent said they could not estimate whether the work would resume during the next two years.

However, 35 percent of all respondents said plans and projects were holding steady, and 6.6 percent said some work has been accelerated during the current downturn.

Adjusting to New Conditions

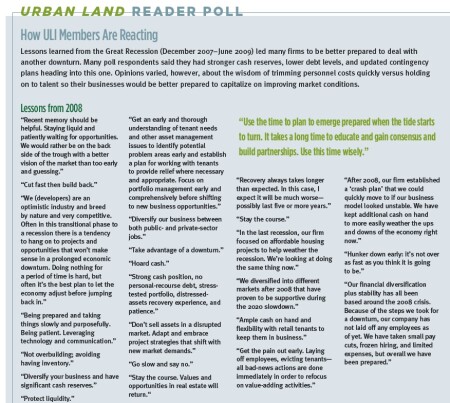

An overwhelming majority of respondents, 75 percent, said they learned lessons from the Great Recession that are proving beneficial to their businesses now. The remaining 25 percent said they did not, including some who noted that they had not been in business at that time. Many respondents said they have kept tighter control over balance sheets since the previous recession, built substantial financial reserves, and minimized debt, all of which put them in a better position going into the current recession than the last.

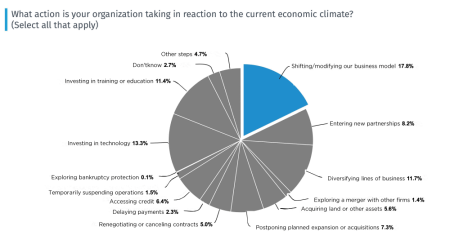

Respondents moved quickly to deal with the current downturn. Eighteen percent said they are shifting or modifying their business models, 13 percent are investing in technology, and 12 percent are diversifying lines of business. Eleven percent are investing in training or education, 8 percent are entering new partnerships, and nearly 6 percent are acquiring land or other assets during the downturn.

Smaller shares of respondents cited less-optimistic steps being taken to preserve their businesses. More than 7 percent said they are postponing planned expansions or acquisitions. Over 6 percent are accessing credit, 5 percent are renegotiating or canceling contracts, and 2.3 percent are delaying payments of some type. Also, 1.6 percent are temporarily suspending operations, 1.5 percent are exploring a merger with other firms, and 0.1 percent of respondents are exploring bankruptcy protection.

Preparing for an Upturn

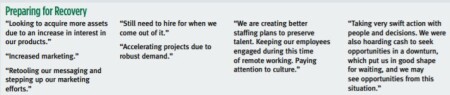

Though many respondents said they learned from the last recession to trim staff at the first sign of a downturn, many others said they are seeking to avoid the loss of talent, which held them back after the previous recession ended.

The largest share of respondents, 27 percent, said they have not made any changes to staffing practices. That was followed closely by the share who have frozen new or replacement hiring—over 22 percent. About 18 percent said they have furloughed employees through a temporary cutback in hours or compensation, and 17 percent said they have laid off employees. Almost 16 percent said they have hired new employees.

ELIZABETH RAZZI and SEAN WALLISCH