When Brooklyn Heights was named New York City’s first historic district in 1965, preservation advocates were delighted. From the modest pre–Civil War federal style to the late-19th-century Greek Revival–style mansions, one of the nation’s most diverse collections of architecture would be permanently preserved. As a report on Brooklyn Heights from the Landmarks Preservation Commission, the newly created arbiter of historic entrée in New York, remarked,

The interesting old buildings arrayed on irregular streets, with unexpected vistas, emanate an appearance and even more a spirit and character of Old New York which no single part thereof, and certainly no individual Landmark, could possibly provide.

This decision came just four years after Jane Jacobs published her seminal book, The Death and Life of Great American Cities, and the preservation movement in New York was in full force. Advocates feared for the loss of not only historical buildings, but also decades of cultural and social connections. It was argued that individual owners did not have the proper incentives to maintain certain qualities of a neighborhood, so a top-down approach would be needed to preserve these fragile urban ecosystems. The Preservation Commission has gone on to designate 120 neighborhoods as historic since its inception.

While the benefits of preservation are clearer, what are the costs? A recent paper, titled “Preserving History or Hindering Growth? The Heterogeneous Effects of Historic Districts on Local Housing Markets in New York City,” describes what happens to property values in different types of neighborhoods when they are designated as historic.

This paper was written by Vicki Been (New York University School of Law), Ingrid Gould Ellen (New York University Robert F. Wagner Graduate School of Public Service), Michael Gedal (Federal Reserve Bank of New York), Edward Glaeser (Harvard University), and Brian J. McCabe (Georgetown University). This collection of economists and policy analysts posits that specific qualities of historical-designated neighborhoods, such as building height restrictions and preexisting desirability, are the leading drivers to whether Landmark-status helps or hurts property values.

In the Heights

When the economic impact of preservation designations is being assessed, desirability is a key consideration, but building heights may be the most significant variable, according to the paper.

If preservation places artificially low limits on building heights, for example, the authors argue that the historical designation will “most likely destroy value when initial heights are . . . low.” This seemingly goes against what Jacobs argued for in the 1960s: Greenwich Village, with its medium-height buildings and optimal mix of residential and commercial occupants, created a very valuable community, and that value would be destroyed with the construction of massive high-rise buildings. But overly constraining redevelopment in a neighborhood may negatively affect overall economic welfare.

According to the authors, the goal of these policies is to “preserve the aesthetic beauty or amenity level of a neighborhood and minimize the risks that new investment will undermine the distinctive character of an area.” Neighborhoods like Greenwich Village are highly desirable places to live (and its charming aesthetic quality and its amenities have a lot to do with this), but by enacting restrictions, like those on building heights, wealth may actually be destroyed. The authors describe this is in a simple economic scenario:

Builders will erect towers up to the height where the marginal benefit of extra space, captured by the price, equals the marginal cost of building up, or up to the legal maximum. They will redevelop parcels to the point where the gain in value from more height on that parcel offsets the cost of redevelopment including land.

In an unrestricted neighborhood, a developer will build vertically until the costs of building up exceed the extra value created. If a neighborhood has restrictions on building heights, however, then it may not financially work to redevelop a property. For redevelopment to make sense, land values must increase to sufficiently compensate for the inability to build higher. But this may not always be the case—land prices may actually decline in preserved neighborhoods because properties no longer have the option to add more housing units on that parcel of land. The result is less total wealth created (though sales prices may increase for individual, existing units), not to mention the negative externality of higher living costs for everyone else. Anybody looking for an apartment in New York in the past decade or two vividly understands this.

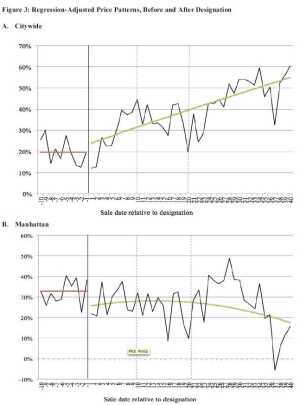

The authors argue that not all preservation designations are negative. They write, “If initial aesthetic levels are higher, preservation can increase value, both for the unit and total real estate.” So the aesthetic argument still holds—many neighborhoods like Brooklyn Heights are valuable because of their aesthetic qualities, and the protection of these neighborhoods can add positive value. The authors found that after controlling for structural differences, a 20 percent premium is placed on properties located in areas that are or will become historic districts. It is in neighborhoods like these where the land value will indeed increase high enough to compensate for regulations like height or style restrictions.

Location, Location, Location

Interestingly, property values increase in historic districts for all boroughs—except Manhattan. Because Manhattan has the highest land values and lowest supply of available land, the loss of the option for redevelopment in preserved neighborhoods reduces the potential value of a given parcel of land. As the authors note, “In areas like Manhattan, it appears that the hit to land values outweighs the boost to structure values, because land values comprise such a large share of total property values.” In many historically designated Manhattan neighborhoods, property prices drop and economic value is destroyed, as shown by the authors’ analysis.

In addition, the authors note that properties just outside the boundaries of historic neighborhoods experience increases in price. This may be due to two factors: first, because of their proximity to desirable preserved neighborhoods; and second, because these properties do not have the same physical or structural constraints as properties located within the preserved districts.

On the Other Hand . . .

Of course, one of the principal axioms of economics is that there are always trade-offs in any decision. In this case, the counterargument is that maximizing the overall level of wealth created should not be the overarching goal within a city. Urban Land Institute Senior Resident Fellow Ed McMahon argues that historic neighborhoods harbor certain qualities that cannot be captured by these types of economic arguments. McMahon says that preservation ordinances are incredibly important to a city like New York, because “historic buildings tell us who we are and where we came from. It’s about saving the heart and soul of New York.”

There are other strategies to helping resolve New York’s affordability problem, according to McMahon. He says, “There are affordable housing opportunities in other parts of New York that are not Manhattan, so we should focus on making affordable housing in areas of the city where land is cheaper. We should also make it easier to restore and adaptively reuse existing buildings. Changing regulations here would make it easier to bring in more supply.”

Anthony C. Wood, formerly of the New York City Landmarks Preservation Commission and the founder and chair of the New York Preservation Archive Project, agrees that affordability and preservation are not mutually exclusive. Wood explains, “Density is good for cities and smart growth, but that we should tear down low density isn’t correct. In New York, a 104-story tower on Park Avenue isn’t actually going to house a large number of people—how many Russian oligarchs and wealthy foreign buyers have bought into these buildings?” The supply-side argument offered by the authors of the paper “should be taken with a grain of salt,” says Wood, “because there are so many forces that make Manhattan expensive. It is too simplistic that the more you build, the better.”

McMahon thinks that if anything, preservation laws should be strengthened. He says, “If you were to change the laws, you’d end up with more high-end housing, not affordable housing.” And by allowing for larger buildings, the entire character of a neighborhood could easily change. As McMahon has previously noted, the personality and source of vibrancy of a neighborhood are directly related to its physical structure. He writes, “Mixed-use and commercial districts made up of small buildings from different eras not only are charming, but they also play an important role in fostering social, economic, and cultural vitality. Smaller, older buildings and blocks ‘punch above their weight class’ when one is considering the full spectrum of outcomes on the per-square-foot basis.”

Groups like the Historic Districts Council (HDC), an advocacy group for the preservation of historic New York neighborhoods, also try to decouple the link between preservation and overall prices across the city. In their recent report, “A Proven Success: How the New York City Landmarks Law and Process Benefit the City,” the HDC says, “There is no direct correlation between affordability, availability, and historic districts within Manhattan’s exorbitant real estate market.” Rather, the number of properties designated as historic has been more than offset by recent redevelopments in nonhistoric neighborhoods like the Far West Village, West Chelsea, and Hell’s Kitchen in Manhattan, and Greenpoint-Williamsburg and DUMBO in Brooklyn.

Don’t Discount Jane Jacobs Entirely

The authors of “Preserving History or Hindering Growth?” finish their paper by noting, “Our results do not capture the external benefits that historic properties provide for society as a whole.” There are intangible, difficult-to-quantify qualities of cities, and they are worth considering in policy decisions—a point agreed upon by both the authors and preservationists like McMahon. But where the two sides diverge is in the balancing of market forces and an invaluable past.

As Jacobs wrote in The Death and Life of Great American Cities, “Cities have the capability of providing something for everybody, only because, and only when, they are created by everybody.” Preservation certainly comes at a cost, but it helps protect both historically important physical structures and immaterial qualities that cannot be replicated in many redeveloped neighborhoods. There are always trade-offs, so cities must find the right mix of preservation and economic value to ensure that neighborhoods can protect what makes them great, but also ensure that they still provide something for everybody.

![Brooklyn Heights was named the first historic neighborhood by the New York Landmarks Preservation Commission in 1965. [CC image courtesy focusshoot on Flickr]](https://cdn-ul.uli.org/dims4/default/cf7a317/2147483647/strip/true/crop/681x1024+0+0/resize/300x451!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fwp-content%2Fuploads%2Fsites%2F5%2F2014%2F12%2Ftodd1-681x1024.jpg)

![[Photo: nyulocal.com]](https://cdn-ul.uli.org/dims4/default/8a0006f/2147483647/strip/true/crop/300x263+0+0/resize/300x263!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fwp-content%2Fuploads%2Fsites%2F5%2F2014%2F12%2Ftodd2-300x263.gif)