As proven development teams look to deliver viable projects a year or more ahead in a recovering economy, construction lenders are now competing for deals in strong markets such as Boston, Dallas, Houston, and Washington, D.C.

A few apartment developers are finally starting to get busy again after the slowest multifamily construction period in the United States in decades. The increase in activity can be chalked up to expected improvements in supply/demand fundamentals in several major markets, low costs of labor and materials, and a somewhat more liquid construction credit environment.

Top 10 ListRental Buildings with Five or Houston - 5,000 2011 Completions Rate Salt Lake City - 1.5% Source: Witten Advisors. |

“We had about 18 months there when banks wouldn’t fund construction loans at any loan-to-cost level,” recalls veteran multifamily mortgage banker Mona Carlton, senior managing director with Holliday Fenoglio Fowler LP (HFF) in Dallas. But as proven development teams now look to deliver viable projects a year or more ahead in a recovering economy, construction lenders are now competing for deals in strong markets such as Carlton’s hometown and Washington, D.C.

As Carlton and others are also quick to point out, banks remain exceptionally selective about developers and the projects they will fund, even in the healthiest marketplaces. “They are underwriting sponsors much more conservatively” than has historically been the case, Carlton observes, adding that the availability of construction financing varies dramatically across the country in line with market fundamentals.

Deep-pocketed developers, including publicly traded real estate investment trusts (REITs), have a leg up on would-be competitors as construction activity starts to revive from a historic trough, adds Bob DeWitt, vice chairman of Boston-based General Investment & Development Cos. (GID). REITs have begun developing their remaining pipelines of land sites in anticipation of yields of 6 or 7 percent rather than acquiring institutional-quality communities at prevailing capitalization rates closer to 5 percent, he says.

DeWitt also cites a rising tide of joint venture development proposals in select markets from private merchant/builder types, adding that demand for land in good locations appears to be growing. Investors providing cash equity to these development ventures are typically targeting internal rates of return in the range of 15 to 20 percent, he says.

But actual construction activity in 2010 has been limited at best, with work starting on only about 75,000 units. That is well below the 200,000 to 250,000 starts typically seen from the late 1990s through the late 2000s, according to Witten Advisors LLC in Dallas.

The pace should pick up substantially to perhaps 120,000 units or more this year, but 2011 will likewise go down as a slow year historically, the Witten team is projecting. The McGraw-Hill Construction forecast has the value of multifamily construction rising 24 percent in 2011 to $23.6 billion.

Active developers and willing construction lenders are responding to improving apartment occupancies and effective rental rates, explains Ryan Severino, an economist with New York City research company Reis Inc. Vacancies have been declining at an exceptional clip across the country in recent months, and the nationwide average should fall further to 6 percent in 2012 from the current 7.1 percent, he says.

Developers apparently also will encounter a strong investment environment as they complete projects: capitalization rates currently averaging 6.7 percent likewise have been falling fast and are likely to continue downward, Severino adds.

Prevailing development costs and pro forma rental rates are helping projects pencil out in several markets across the country. Along with the Dallas–Fort Worth Metroplex (a distant second) and the District of Columbia and the surrounding area (third place), the Witten group’s compilation of the most active 2010 apartment construction markets includes Houston—far and away the leader—Los Angeles, Tampa, Seattle, Baltimore, Boston, Miami, and Indianapolis.

Indianapolis, Tampa, and Baltimore also join Salt Lake City, Raleigh, and Norfolk among metropolitan areas likely to see their apartment inventories grow by at least 1 percent this year, Witten projects.

Given recent employment trends, renter demand should remain relatively robust in markets with exceptional ties to growing fields such as exports and health care. Markets disproportionately dependent on weaker sectors, including construction, finance, and manufacturing, may not fare as well.

Greg Willett, vice president of research at MPF Research in Carrollton, Texas, sees the Washington metro area leading the pack as development activity picks up further in coming quarters. He also expects the big markets in his home state to attract substantial development going forward because of their current economic strength and projected employment growth.

Severino notes that Phoenix, the San Francisco Bay Area, and Denver are also on the list of markets seeing the most multifamily investment activity. DeWitt also anticipates further institutional equity commitments in the New York/New Jersey metropolis and Austin, in addition to GID’s home base in Boston.

While the classic garden-style, market-rate complexes appear to account for a substantial chunk of the newest multifamily developments, some seniors’, student, and affordable housing projects are likewise coming out of the ground.

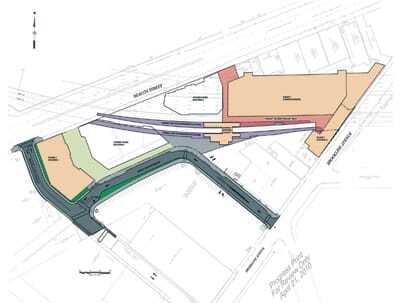

Boston ranks among select major markets seeing apartments anchor noteworthy urban infill projects. For instance, locally based developer John Rosenthal broke ground in November on Fenway Center, a $450 million solar-powered neighborhood near Fenway Park. Its first phase includes a pair of seven-story apartment buildings and a ground-floor organic grocery, with more multifamily housing planned, in addition to multiple other uses. A month earlier, Synergy Investment & Development, another local group, started erecting the $20 million One Webster, which will have 120 units of market-rate apartments and 5,000 square feet (465 sq m) of retail space on a former industrial site at Eastern and Webster avenues. Also, area developer Ori Ron’s Hudson Group North America is about to launch a 26-story tower along Chinatown’s periphery slated for 100 rental units and an equal number of condominiums.

While DeWitt still perceives wariness among construction lenders toward mixed-use developments absent considerable commercial pre-lease commitments, he is bullish on prospects for urban infill apartment projects. “Mid-rise, podium, and ‘wrap’ product have the best rent-to-cost metrics today and therefore will be the first to be financed and built.”

Indeed, nearly all the current apartment development is in single-use rather than mixed-use configurations because “nonresidential uses for the most part just do not pencil out at prevailing construction costs and effective rental rates,” Willett says. “Apartments are the only real estate product where construction starts make sense at this point in lots of markets.”

As he and others note, the latest projects also generally tend to be relatively small by recent standards, and in some cases have smaller units as well. As lenders continue limiting the loan proceeds they will advance toward a given project, developments under-way now are frequently smaller than was the norm in the previous cycle, Willett observes. “And the focus is on stick construction, rather than high rises,” he says.

Exceptions exist, and some of the financially hefty REITs “have the cash to get going on some big, very-high-end projects, including mid-rise developments in premium locations,” Willett acknowledges. For example, Arlington, Virginia–based AvalonBay Communities alone had no fewer than a dozen developments under construction at the beginning of the fourth quarter, as well as seven others labeled “under reconstruction.”

As for the costs and terms of financing apartment construction, debt rates today are extremely attractive. The problem for most wannabe developers is that although terms are better than they were in early 2010, it is still very tough to qualify for a construction loan. And loan-to-cost ratios remain quite conservative, which means “developers have to put more skin in the game,” Willett says. Banks are more aggressively seeking multifamily construction financing opportunities than they were during the first half of the year, but only from strong sponsors, adds DeWitt.

Banks are mostly willing to fund apartment construction at 60 to 65 percent loan-to-cost ratios, HFF’s Carlton specifies. The better news is that today’s low-interest-rate environment often translates to debt costs in the low to mid–5 percent vicinity. Current pricing spreads typically vary anywhere from about 220 to 350 basis points over the LIBOR index, depending on the project profile, submarket conditions, and development team, she adds.

But in the strongest markets, banks competing for deals might quote a loan-to-cost ratio of up to 70 percent and a spread of as little as 200 basis points over the LIBOR index for top projects, Carlton says. In this environment, long experience and a successful track record are critical, she cautions.

Administrative improvements have also made the Federal Housing Administration’s (FHA) 221(d)(4) apartment construction/permanent mortgage insurance program more palatable to entrepreneurial developers. But as Carlton notes, new loan-to-value limits that went into effect in July mean FHA now guarantees loan amounts factoring to 80 percent of projected replacement costs, down from the previous 90 percent. “That means you need more equity now, but it’s still far less than with bank financing,” Carlton notes. A just-completed example of a large development funded through the 221(d)(4) program is the 432-unit Bella Apartment Homes four miles (6.4 km) from Walt Disney World in Kissimmee, Florida; its developer is an affiliate of Village Partners, based in nearby Davenport.

DeWitt anticipates that more conventional construction loans will be funded in the coming year. “The overall consensus among our banking relationships seems to be that things are improving, and that 2011 is projected to be an active year” for apartment construction lending, he concludes.