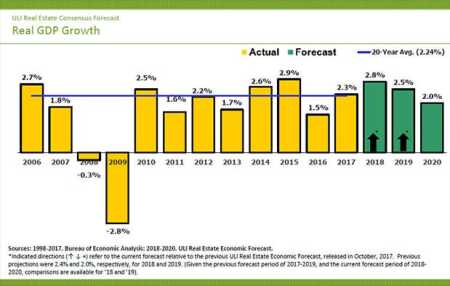

The latest ULI Real Estate Economic Forecast is taking a more bullish view on the U.S. economy—at least for the remainder of this year. As compared with the fall survey, key indicators such as gross domestic product (GDP) growth, jobs, and the Consumer Property Price Index (CPPI) all trended higher. But that boost may be short lived with growth tapering in 2019 and 2020.

“The outlook for the U.S. going into 2018 and probably into 2019 is extremely strong. There is quite a lot of geopolitical noise, but I don’t expect that to impact the economy,” says Richard Barkham, global chief economist at CBRE. Barkham was one of several panelists who participated in a webinar presentation of the forecast on April 18.

The United States went into 2018 with good momentum along with optimism that tax reform would provide added benefit to corporate and personal spending. Another positive in the global economy is that China has not slowed its GDP growth as some had expected. “That’s a major locomotive on the global economy that is surprising on the upside,” says Barkham.

Beyond 2018, the outlook for both the economy and commercial real estate is for positive, but slower, growth. There is a possibility that the economy could be a little weaker than what the forecast suggests, adds Barkham. After ten years of exceptionally low interest rates, rates are expected to move higher over the next two years. The rising interest rate environment, especially in a global market where there is still quite a lot of debt, could present a big downside risk after mid- to late 2019, he says.

Ten-year Treasury rates that reached 2.4 percent at year-end 2017 are forecast to climb to 3.1 percent this year and 3.4 percent in 2019 and remain at that level in 2020. This new normal in the low to mid-single digits is still very good for business and for the commercial real estate market, says Diana Reid, executive vice president at PNC Financial Services. Yet some uncertainty remains on how markets that have lived with extremely low interest rates for the past decade will react to a rising interest rate environment.

Subdued Growth Ahead

The prolonged economic growth cycle is good news for the commercial real estate market. Commercial real estate prices are projected to continue to grow, although at lower rates relative to those seen in recent years. The RCA Commercial Property Price Index shows declining values ahead. After dropping to 7.7 percent last year, the index is expected to decline further to 5.0 percent in 2018, 3.0 percent in 2019, and 2.3 percent in 2020.

Commercial property rents also will continue to grow over the next three years in all sectors, although at more subdued rates than in recent years. “Looking at the survey overall, we see relatively stable occupancy conditions across property types and generally late-cycle declining rent growth over the three-year projection period,” says Mark Wilsmann, managing director and head of equity investments at MetLife Real Estate.

Industrial is the outlier that is showing the strongest fundamentals. Compared with six months ago, the new forecasts for 2018 are more optimistic for the industrial sector and unchanged or less optimistic for the apartment, retail, and office sectors. Industrial is continuing to benefit from the rise of e-commerce and omni-channel distribution. Users also are requiring highly efficient facilities, which is further driving demand for industrial space.

Industrial/warehouse space availability remains steady. The vacancy rate is expected to hold at 7.4 percent for the third year in a row before ticking higher to 7.5 percent in 2019 and 7.7 percent in 2020. The forecast is for healthy, but slower, rent growth ahead at 4.6 percent in 2018, 3.8 percent in 2019, and 3.0 percent in 2020.

After seven years of slow recovery, office vacancies ticked 10 basis points higher to 13.0 percent last year, where they are expected to remain in 2018 before inching higher to 13.2 percent in 2019 and 13.4 percent in 2020. However, it is notable that both vacancies and rent growth are outperforming compared with the 20-year averages. Office rental rates increased by 2.0 percent in 2017, just above the 20-year average of 1.9 percent. Rental rate growth is expected to increase at a rate of 2.5 percent in 2018, before edging back down to 2.0 percent in 2019 and 1.5 percent in 2020.

Challenges Persist for Retail

Retail performance looks solid on paper. Vacancies have declined from a peak of 12.8 percent in 2011 to 9.6 percent in 2017 with a forecast that calls for slight increases ahead, edging up to 10 percent by 2020. However, the forecast does not reflect what has become a very bifurcated market. The current scenario is a little like standing with one foot on a block of ice and the other on very hot sand. The median temp is probably quite comfortable, but that is not what’s happening in today’s retail market, says Martin Stern, a senior managing director at CBRE.

Some areas, such as the urban core, discount retailers, and well-located malls, are doing quite well, while other sectors and locations are struggling. What that means is that a lot of opportunities still exist, but investors have to be very, very careful about what they are buying and where they are buying, because some retail won’t survive, adds Stern. The forecast also calls for slowing retail rent growth ahead. After growing at 3.1 percent in 2017, rent growth is expected to fall to 2.0 percent this year, 1.8 percent in 2019, and 1.1 percent in 2020.

Even with continued strong construction activity, the apartment sector has delivered a strong performance over the past several years. Vacancy rates remain below the 20-year average of 5.4 percent, although vacancies are forecast to edge slightly higher to 5.0 percent in 2018 and 5.2 percent in 2019 and 2020.

“I am a little more worried about multifamily,” says Stuart Hoffman, senior economic adviser at PNC Financial Services. Aging millennials may actually find homeownership to be more attractive as they get older, especially in a market where home prices are rising. In addition, a lot of multifamily has been built and is in the pipeline. “So, I would argue that there is more downside risk for multifamily,” he adds.

Apartment rental rate growth was negative in 2017 for the first time since 2009, with rates decreasing by 0.3 percent. Rental rate growth is expected to be positive but moderate over the next three years at 1.5 percent in 2018 and 2.0 percent in both 2019 and 2020.

Construction Costs Will Influence Outlook

Another big issue for all property types going forward is rising construction costs. Land, construction, and labor costs are going up in almost every market around the country. “That cost of new construction compared to the cost of purchasing something that may be underutilized is a different calculation than it was a few years ago,” says Reid. In addition, there is still a real supply crisis in affordable and workforce housing, and rising construction costs will only make that problem worse, she adds.

Construction costs are a concern, and other factors that could push costs higher still are U.S. policies related to trade and immigration. “If everything breaks the wrong way on those things, we’re going to see a bigger impact on new construction than what we are thinking about,” says Stern.

However, higher construction costs also are creating tremendous opportunities for value-added projects for well-located properties that can be renovated or repurposed, adds Stern. “I think we are going to see more and more in retail, housing, and even office in repurposing buildings for additional and better uses, because it will be a cheaper way to deliver the right product,” he says.