The housing sector is finally helping the U.S. economic recovery, rather than holding it back. But more Americans than ever now spend more than half their income on housing, according to The State of the Nation’s Housing 2013, a report released June 26 by the Joint Center for Housing Studies (JCHS) at Harvard University.

“Clearly, we are in a strong housing recovery now,” said Eric Belsky, managing director of JCHS.

+ Related: Download the Full Report | Executive Summary

Every major home price index registered significant price increases in 2012—including a 12 percent increase over the past year, according to April’s Case-Shiller home price index. And prices have more room to grow. “There is a lot of upside to anything we would consider normal or trend,” said Belsky, speaking at the release of the report.

The demand for housing also continues to strengthen. The number of U.S. households grew by 980,000 in 2012, up sharply from growth averaging 600,000 per year over the last five years. The growing number of adults in the United States, including the number of young people graduating from college, should support the creation of about 1.2 million new households a year for the rest of the decade.

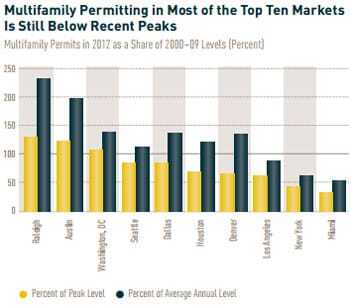

In response, developers have finally begun to build both single-family and multifamily housing again. “With rising home prices helping to revive household balance sheets, and expanding residential construction adding to job growth, the housing sector is finally providing a much-needed boost to the economy,” said Belsky.

Notes: Severely cost-burdened households spend more than 50 percent of pre-tax income on housing costs. Incomes are in constant 2011 dollars,

adjusted for in?ation by the CPI-U for All Items.

Source: JCHS tabulations of US Census Bureau, American Community Surveys.

Left Behind

The number of people burdened by high housing costs, however, has continued to grow. At last count in 2011, over 40 million households paid more than 30 percent of their income for housing. That includes 20.6 million households that paid more than half of their income for housing.

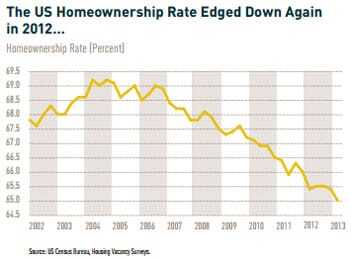

Low home prices and interest rates could help some of these people improve their housing situation. When combined with the sharp drop in home prices, today’s low mortgage interest rates have made owning a home more affordable than at any time since the 1970s. So far, however, these conditions have failed to boost first-time homebuying.

Many people who might have easily qualified for a home mortgage in the years before the housing bust often cannot get a home loan today. The average credit scores of conventional-mortgage applicants denied credit in the first quarter of 2013 were 722 for refinancings and 729 for purchases. “Tight credit is limiting the ability of would-be homebuyers to take advantage of today’s affordable conditions and likely discouraging many from even trying,” said Chris Herbert, director of research at JCHS.

That is having a clear effect on younger people. The homeownership rate in 2012 for people between 25 and 54 years of age was at its lowest point since recordkeeping began in 1976. A proposed regulation that would require a 20 percent downpayment to purchase a home could pose another substantial obstacle for many of tomorrow’s potential homebuyers—especially first-time homebuyers. “I don’t think we are going to have a long-term housing recovery without the first-time homebuyer,” said Debra Still, chairwoman of the Mortgage Bankers Association.

Potential homebuyers in certain ethnic groups have an especially difficult time getting financing: banks declined to lend to 36.9 percent of African Americans seeking conventional home purchase loans—more than twice the 14.0 percent denial rate for white borrowers. At 43.9 percent, the homeownership rate for African American households is at its lowest level since 1995, compared with the 73.5 percent rate for white households.

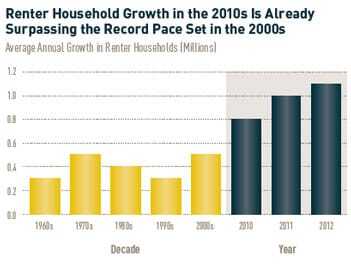

As homeownership rates decline, households have been moved into the rental market. The number of renter households grew by more than a million in 2012 alone. Strong demand for rental housing gives landlords the ability to raise rents, even in a slow economy. April 2013 marked the 34th consecutive month of growth in rents as measured by the Consumer Price Index, and the 15th consecutive month of year-over-year increases of 2.5 percent or more.

Low household incomes leave households vulnerable and less able to take advantage of opportunities. Average incomes for households led by people under the age of 35 are lower today than they were in the 1990s. The recession had an even bigger impact on households headed up by people between the ages of 35 and 54—their incomes are now lower than those of similarly aged households in 1971.

“Efforts to address these urgent concerns as well as longstanding housing affordability challenges should be among the nation’s highest priorities,” said Belsky.