Investors are cautiously optimistic about investment and development prospects in the Chinese Mainland’s Tier 1 and leading Tier 2 cities, as well as those located in economically prosperous coastal regions, as demand for new housing and office space rises with the country’s burgeoning high-tech industry and the expansion of high-speed rail lines and subway infrastructure, according to Chinese Mainland Real Estate Markets 2015, released by the Urban Land Institute (ULI).

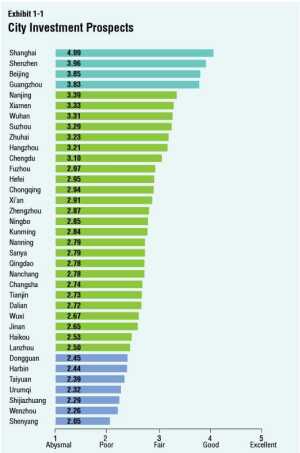

The annual survey, which ranks the real estate investment and development prospects of 36 of China’s most populous cities, reflects an average 5.7 percent increase in ratings for each city’s investment prospects and a 1 percent increase in ratings for development prospects over last year, based on written responses from and interviews with leading domestic and foreign investors and developers active in China’s real estate markets. For the second year in a row, the four Tier 1 cities—Shanghai, Shenzhen, Beijing, and Guangzhou—all received top rankings from survey participants.

According to Ken Rhee, coauthor of the report and the ULI chief representative for the Chinese Mainland, “Tier 1 cities are increasingly popular with developers and investors for various factors including maturity of the markets, the fast-growing service sector including the IT industry, and accelerating integration with nearby cities aided by high-speed rail.”

Overall, the survey reflects more optimistic assessments of Tier 2 and Tier 3 cities, with only seven of these cities rated as “poor” in investment rankings compared with 11 in 2014. Nine cities rated “poor” for development prospects compared with 11 last year. The report notes that the “lower-ranked cities contributed some of the biggest gains in ratings between 2014 and 2015 in investment prospects, while gains in development prospects were more equally distributed” among all 36 cities.

China’s continued expansion of high-speed rail bodes well for a growing number of Tier 2 and Tier 3 cities as it has accelerated their integration into major economic hubs such as the Yangtze River Delta and the Pearl River Delta, the report notes. Provincial capitals Hefei (13th in the ranking), Nanchang (22nd), Nanning (19th), and Zhengzhou (16th) were rated higher this year in the investment category due to the rapid pace of urbanization in these areas and improving transportation infrastructure such as high-speed rail and/or subway.

The survey also attributes the slow-but-steady rebound of real estate markets to the phasing out of home-purchasing restrictions that were put in place across the country in 2013 to curb speculation. Although these restrictions remain in effect in Tier 1 cities and the resort city of Sanya (20th in the ranking), their removal in most cities has in fact boosted home sales, the report notes. Interest rate cuts across the country since November 2014 also have spurred homebuying, and home prices are starting to rise once again in approximately half of the cities in the survey. However, enthusiasm remains tempered in several other lower-ranked cities such as Shenyang and Tianjin since some still suffer from a substantial oversupply of product or land.

The survey includes an analysis of various real estate sectors—office, retail, residential (both midmarket and luxury), and industrial/distribution—based on survey responses. The office market continues to dominate investment decisions. Tier 1 cities continue to develop into hubs for information technology and knowledge-based industries, both in central business districts and suburban and decentralized locations that are well connected by public transportation networks. While office vacancy rates remain low in Tier 1 cities, oversupply of office space remains a concern for a number of Tier 2 and Tier 3 cities that have a large-scale new project in their central business districts.

Retail continues to suffer due to oversupply and the rise of e-commerce, leaving some shopping malls suffering from compressed rents and rising vacancy rates, even in good locations of Tier 1 cities. Some respondents see an opportunity for consolidation of the retail property market, with less experienced developers and owners exiting the sector.

The survey also ranks cities by livability, and this list correlates closely with the air quality in each market. In 2015, Hangzhou takes the top spot, followed by Shanghai in second place. Beijing, known for its smog and air pollution, is ranked near the bottom of the list, at 31.

The top five rated cities for investment prospects in 2015 are as follows:

Shanghai: China’s most populous city continued to inspire confidence among survey respondents, who singled it out as a future “global city,” eventually on par with London, Paris, New York, and Tokyo. A decreasing stock of developable land in central locations has led to an increase in new supply in decentralized locations such as Hongqiao Transportation Hub.

Shenzhen: Shenzhen’s ratings improved the most among the Tier 1 cities. The office market in particular has been a stellar performer, with vacancy rates declining to 4.6 percent in 2015 from 7.5 percent in 2014. Shenzhen, too, is experiencing a major influx of migrants, who represent 73 percent of its permanent population, which respondents say bodes well for its growth. The high-tech and information technology sectors in Shenzhen are also seen as drivers of an educated, entrepreneurial, and highly skilled workforce. Shenzhen benefits from the growing integration of the Pearl River Delta catalyzed by the high-speed rail that links Shenzhen to Guangzhou and, in the near future, to the Hong Kong Special Administrative Region and the growth of Qianhai area as a special economic zone.

Beijing: Beijing’s top-performing sector continues to be office, fueled largely by the information technology industry, according to the report. The tight office market is leading to the conversion of other types of property for office use and the emergence of decentralized office areas. While the city scores low on the report’s livability ranking, one survey respondent remarked that the real estate market in Beijing is driven by jobs, rather than by living standards.

Guangzhou: Receiving more mixed reviews compared with other Tier 1 cities, Guangzhou was nonetheless included among the most-favored cities, ranking among the top for each of the four major property types. The office market has stabilized, having absorbed most of the substantial new supply in Pearl River New Town and is supported by a growing IT sector. Retail and residential sectors in Guangzhou are considered stable.

Nanjing: Occupying the number-five spot again this year, Nanjing was rated as “fair” in investment prospects and “good” in development prospects. Survey respondents praised the city’s investment in higher education and emerging high-tech industries, noting that it “has a very good fabric to form a promising city.” It has been a key beneficiary of the growing integration of the Yantze River Delta aided by high-speed rail.