The sustained performance of the U.S. commercial real estate industry is expected to continue in 2015, fueled by improving fundamentals and robust investor appetite—both domestic and foreign—according to Emerging Trends in Real Estate® 2015, copublished by the Urban Land Institute and PwC U.S.

“Unlike previous reports and previous cycles, we are seeing sustained growth,” says Mitch Roschelle, partner, U.S. real estate advisory practice leader, PwC. “In the past several years, we reported that real estate market participants’ main fears revolved around the uncertainty with the economy. Now, the trepidation in their eyes has more to do with the ability of the growing real estate markets to adapt to a series of megatrends impacting society and the global economy. These megatrends include accelerating urbanization, demographic shifts, and the impact of distributive technological advancements.”

ULI Global Chief Executive Officer Patrick L. Phillips pointed to the continued rise of markets other than the largest coastal cities as top choices for overall real estate prospects. Houston and Austin, which are ranked first and second, respectively, topped San Francisco as favorites for 2015; Charlotte, North Carolina, in seventh place, is rated higher than Seattle and Boston; and Nashville, ranked at 14, tops Manhattan. “Investors are looking closely at opportunities beyond the core markets. These cities are positioning themselves as highly competitive, in terms of livability, employment offerings, and recreational and cultural amenities,” Phillips says.

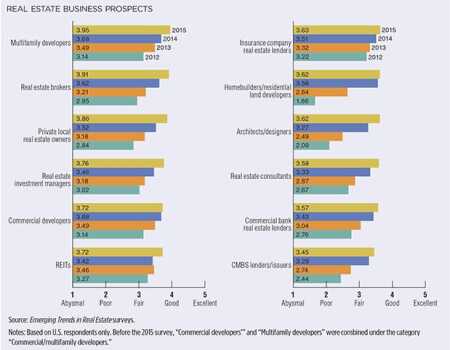

Now in its 36th year, Emerging Trends in Real Estate is one of the most highly regarded annual industry outlooks. It includes interviews with and survey responses from more than 1,000 leading real estate experts, including investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants.

Top Trends

This year’s report outlines expectations for the coming year:

- The 18-hour city comes of age. No longer is it accepted that only the great coastal cities can be alive around the clock and on weekends. Downtown transformations have combined the key ingredients of housing, retail, dining, and walk-to-work offices to regenerate urban cores, spurring investment and development and raising the quality of life.

- The changing age game. While the tendency of millennials to rent longer and postpone homeownership will affect the apartment sector over the next several years, many survey interviewees note that investors should consider how millennials’ housing preferences could change during the 2020s. The report anticipates further industry changes resulting from the emergence of the smaller “generation Z” that follows the millennials. Planning for a nation in the 2020s with lower rates of household formation, fewer new consumers, and a meager number of workforce entrants is the challenge ahead for the real estate industry.

- Labor markets trend toward a tipping point. Forward-looking businesses are realizing that while they were worried about the “jobless recovery,” longer-term labor market trends were moving in exactly the opposite direction. Retirements will accelerate, while the peak period of millennials entering the labor force has already passed. Within a few years, the talk will be about labor shortages, not surpluses, and the notion that “jobs are chasing people” will morph into a primary rule of the labor market. Survey respondents place job growth at the top of the list of most important issues for real estate, closely followed by the related concerns of wage and income growth.

- Real estate’s relationship with tech intensifies. Interviewees see technological disruption as providing new business tools and environments, opening new business paths, and cycling forward as a source of user demand in an era when more traditional industries may be sluggish. Technology is pushing change in space use, locations, and demand levels at an accelerated pace. It is now the norm to anticipate, strategize, and respond to new technologies before they become mainstream. Overall, fear about technological disruption is easing. E-commerce and crowdfunding, for example, are being viewed as an adaptation challenge, as retailers become “omnichannel distributors” and e-tailers begin to open brick-and-mortar stores.

- Event risk is here to stay. There is nothing new in seeing people and institutions alike investing along the continuum from core to opportunistic, but the trend will be that such distinctions are heightened over time. Such heightening will be especially evident in 2015, interviewees note, because concern about event risk, such as disruption from geopolitical events, global unrest, and natural disasters, is troubling ever more interviewees.

- A Darwinian market squeezes companies. Competition is unrelenting, and the need to have a clear brand identity is important as firms seek to navigate in the swift stream of capital. The recent spin-off activities in the retail, office, and hospitality real estate investment trust (REIT) sectors sounded a theme that will echo as a trend in 2015. The drive for efficiency and effectiveness in both service delivery and cost will filter from investor expectations down to the service providers.

- A new 900-pound gorilla swings into view. Last year’s edition of Emerging Trends alerted readers to the establishment of the Defined Contribution Real Estate Council to help plan sponsors and their participants achieve better investment outcomes through the use of institutional-quality real estate. With a combined $12.6 trillion in capital, individual retirement account (IRA) and defined contribution (DC) funds will be identifying and taking advantage of the benefits of having high-quality commercial property in mixed-asset portfolios.

- Infrastructure: time to get serious? For all the technological innovations the United States has produced, the very foundation of the nation’s commerce is eroding. And it’s not just bridges and roads. Since 2009, spending on education buildings and health care facilities (by both the public and private sectors) is down by one-third in real-dollar terms.

- Housing steps off the roller coaster. The residential real estate sector looks to be returning to the classic principles of supply and demand. As this major segment of the economy goes back to textbook fundamentals, confidence in the residential sector should continue to rise.

- Keeping an eye on the bubble—emerging concerns. Upcycles breed optimism, but excessive optimism can promote bad investment patterns. However, in most cycles, overbuilding and excess leverage would likely have started building momentum by now. To the degree that that has not happened, the industry looks like it has learned some lessons in self-regulation and self-correction.

Markets to Watch

Real estate investors continue to be willing to pay record prices for assets in the major markets because these markets, which are limited in number across the globe, offer less-volatile returns of capital. This year, interviewees expressed a desire to take on a measured amount of new risk in search of higher yields. Two strategies mentioned repeatedly by interviewees focused on moving to more opportunistic-style investments in the major markets or in markets close to a major metropolitan area, or looking for the best assets in markets outside the core major markets. This year’s market rankings reflect the attractiveness of markets for both of these strategies.

Following is a snapshot of the outlook for the top five markets ranked by survey respondents:

- Houston: Investors believe that the energy industry will continue to drive market growth and that that will support real estate activity in 2015. Houston was ranked number one in both investment and development expectations for next year; housing market expectations are ranked number two.

- Austin: Interviewees like the industrial base, the appeal to the millennial generation, and the lower cost of doing business in Austin. The market was a top choice for both the office sector and the single-family housing sector and the number-two market for retail. Interviewees are also attracted to Austin’s diverse employee base, and cite the market as an example of “jobs chasing people.”

- San Francisco: The decline from the number-one spot last year is due more to growth in the other cities than to any identifiable flaw in the San Francisco market. The strong local economy and improved domestic and international travel have made San Francisco the number-one choice for hotel investment in 2015. Respondents rank the office market number three and the retail market number four.

- Denver: Denver joins Austin and San Francisco as markets popular with the millennial generation. Denver’s industry exposure to the technology and energy industries has also attracted investor interest. The results of the survey put Denver retail at number five and office at number six.

- Dallas/Fort Worth: Interviewees raise the possibility that despite being ranked lower than Houston, economic diversity could make the current growth rate more sustainable in Dallas/Fort Worth. The market continues to be attractive to real estate investors because of its strong job growth, which benefits from the low costs of living and doing business. Single-family housing in the market is the highest-ranked property sector—and it has the highest-ranked industrial sector (number four) among the top five markets from this year’s survey.

Property Types

- Industrial: Since 2010, the industrial property sector has enjoyed rising demand while additions to supply have not kept pace. Come 2015, however, the industrial sector is entering a period when projected construction is accelerating, but demand is anticipated to decelerate. Last year, many interviewees really liked the sector—a feeling that has not changed for many. The industrial sector stands atop the sector rankings for investment.

- Hotels: The prospects for liquidity in the hospitality sector shape up as excellent for 2015. Remarkably, and in distinct contrast with most other property types, the survey shows no expectation of any alteration in cap rates for hotels. This year’s Emerging Trends survey shows hotels—especially in the limited-service category—rated strongly in participants’ 2015 outlook for investment and development.

- Apartments: Respondents seem sharply divided in their opinions. For high-end multifamily, nearly half the respondents (48 percent) think it would be smart to divest in 2015, while 30 percent consider it worthwhile to hold for a longer period. Only 21 percent suggest that this is a good time to buy. At the more moderate income level, that relationship was reversed: only 28 percent recommend selling, while holding and acquisition are more attractive, with 37 percent and 35 percent, respectively, recommending these as opportunities in the year ahead.

- Offices: One of the more powerful trends for offices—the live/work/play theme—is not just hype, but is statistically significant. The resurgence in downtown living is bolstering secondary office markets around the country. In addition, the drive toward space compression in office use is about at its end, and in the coming years the quality of the office environment will be used as a marketing tool to recruit talent. The millennial generation will not put up with the space cram-down much longer, especially as it gains seniority in the workforce. Greater flexibility and variety in office space design will be superseding cost-cutting as a prime imperative. And if the millennial generation’s impact is still evolving, so too is the boomers’ impact. Survey respondents grasp the inexorable path of demand growth for medical offices—which is seen as a “buy” for 2015 by 36.3 percent of respondents, and a “hold” by 40.6 percent, with only 23.1 percent advising “sell.”

- Retail: Investment and development strength in the retail sector ranks the lowest of all the major property types in the survey. Just as the slow recovery in jobs has hindered many other economic growth indicators, so too has the jobs recovery made real estate professionals wary of calling a bounce back in retail.

- Housing: Housing is well on the way back, according to survey respondents, and they rank urban/infill as the top opportunity for 2015. Yet, the after-effect of the housing bubble has not fully dissipated, and this will partially shape demand for the next several years. Even with jobs on the rise, doubling up in either parents’ homes or with several roommates is an accepted norm, even if temporarily, for millennials. This version of a “new normal” is not permanent, but it will linger because of the combination of high student loan indebtedness, meager growth in wages and salaries, and inadequate savings.

Trisha Riggs is ULI vice president for strategic communications.

Copies of the new Emerging Trends in Real Estate report are available for download at http://uli.org/et15.