Despite a slower-than-normal real estate recovery track, U.S. property sectors and markets will register noticeably better prospects in 2013 compared with 2012, according to Emerging Trends in Real Estate, an annual report published by ULI and PwC.

The forecast report, now in its 34th edition, reflects opinions obtained through surveys of and interviews with more than 900 industry experts, including investors, fund managers, developers, property company leaders, lenders, brokers, advisers, and consultants.

The forecast for 2013 indicates that recent job creation should be enough to increase absorption and push down vacancy rates in the office, industrial, and retail sectors, helped by the limited new supply in commercial markets. Robust demand for apartments should hold up, survey respondents indicate, even as new construction ramps up—and even the housing sector should make progress in most regions. In addition, improving fundamentals should help with rents and net operating incomes, building confidence about sustained growth and strengthening recent appreciation.

“This is our recovery,” Jonathan D. Miller, principal author of the report, said when presenting Emerging Trends at ULI’s Fall Meeting in Denver. “It’s a recovery, but anchored in considerable uncertainty,” he said, citing Europe’s economic troubles, a slowdown in China, and the “fiscal cliff” looming in the United States. But the forecast says modest gains in leasing, rents, and pricing will extend across U.S. markets from coast to coast and improve prospects for all property sectors.

Apartments have gotten “rather pricey,” Miller noted, but he said there does not appear to be overbuilding in top, 24-hour international gateway cities. If there is overbuilding, it is likely to be in secondary and tertiary markets where high barriers to entry do not exist.

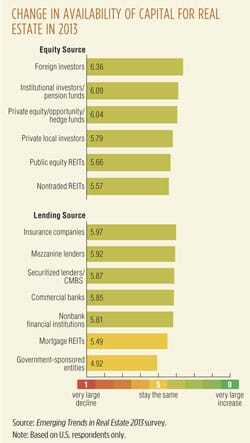

“With the outlook for commercial real estate continuing to improve in 2013, investors are expected to allocate substantial sums of capital to the real estate asset class, according to our survey respondents,” said Mitch Roschelle, a partner and U.S. real estate advisory practice leader at PwC. “As yield on bonds and other financial instruments tightens in a still-volatile market, commercial real estate’s income-producing and total-return attributes offer investors potentially attractive risk-adjusted returns.”

Stephen Blank, ULI senior resident fellow for real estate finance, noted that investors must keep in mind recent progress in the industry as they prepare for a slow but steady recovery. “What these findings suggest is that, in general, the industry is moving forward bit by bit,” he said. “Nothing indicates a quick turnaround for commercial real estate, but it is improving. Those who are patient and willing to rethink their expectations and adapt to market realities are the most likely to come out ahead next year.”

Capital Chases Yields

Despite macro-economic concerns, the 2013 Emerging Trends report forecasts that investors will return to greater risk-taking in their portfolios in an attempt to gain more yield. Even as riskier secondary markets show up on investors’ radar, many believe the move cannot be made without concentration on leasing to high-quality tenants within growth industries that are sustainable. However, as property prices meet or exceed pre-recession levels in Boston, Chicago, Los Angeles, New York City, San Francisco, and Washington, D.C., the focus of property investors has shifted more to the lessee’s value, various market demographics, a city’s economic output, diversification, job growth, and where people want to live.

According to the report, investment capital’s interest in commercial real estate is expected to increase as other asset classes continue to offer minimal returns or too much volatility. In fact, Emerging Trends found that only six of the 51 markets covered exhibited a decline in investment prospects.

Transaction volume is expected to tick up with more action in 2013, according to Emerging Trends. Pricing is predicted to strengthen, but increases will be muted until credit markets return to more normal levels. Commercial mortgage–backed securities (CMBS) may return to the financing spotlight once transaction activity increases. Interviewees expect CMBS issuance to return to $75 billion to $90 billion over the next several years.

Respondents to the Emerging Trends survey cited a number of best moves for investors in 2013, including the following:

- Concentrate acquisitions on budding infill locations. Top urban markets outperform the average, bolstered by move-back-in trends and generation-Y appeal. Top core districts in these cities have become too pricey, so look in districts where “hip” residential neighborhoods meet commercial areas.

- Construct new-wave office and build to core in primary coastal markets. Major tenants willingly pay high rents in return for more efficient design layouts and lower operating costs in Leadership in Energy and Environmental Design (LEED)–certified, green projects.

- Develop select industrial facilities in major hub distribution centers near ports, rail corridors, and international airports. In these markets, the industrial sector is driven by tremendous demand by large-scale users looking for specialized space and build-to-suit activity.

- Use caution investing in secondary and tertiary cities. Focus on income-generating properties and partner with local operators who understand tenant trends and can leverage their relationships. Markets grounded in energy and high-tech industries show the most near-term promise, whereas places anchored by major education and medical institutions should perform better over time.

- Begin to back off apartment development in low-barrier-to-entry markets. These places tend to overbuild quickly, softening rent growth potentially and occupancy levels probably by 2014 or 2015.

- Consider single-family housing funds. Housing markets will finally get off the bottom, and major private capital investors will move into the sector. Concentrate investments with local players who know their markets and can manage day-to-day property and leasing issues.

- Repurpose obsolescent properties, which are in oversupply. Whether they are abandoned malls, vacant strip centers, past-their-prime office parks, or low-ceiling warehouses, an overabundance of properties requires a rethink, a teardown, and, in many cases, a new use.

Investors Follow Job-Producing Markets and Echo Boomers

During recessions, some investors have sought more economically diverse markets to weather job losses and declines. Now, however, in a time of slight economic uptick, Emerging Trends results indicate that investor sentiment is focused on job-producing industries and the markets that contain them, regardless of how diverse the businesses are that are producing those jobs.

The best housing markets, according to the report, will provide better commercial real estate options because a housing sector recovery generates more jobs and demand for vacant commercial real estate. At the same time, banks will free up funding and a multiplier effect will ensue. Even though the housing market is starting to improve, demand and interest in apartments in “American infill” locations remain attractive, leading to a boom in apartment development. Leading this cyclical move are the echo boomers, who are delaying plans of homeownership.

Among the prospects for property sectors in 2013, the survey finds that commercial and multifamily regain generally solid investment ratings. Categories hold their relative rankings from 2012 in the survey, with the persistent leader, the apartment sector, still on top, though noticeably leveling off. Retail continues to lag, but is recovering. The industrial/warehouse and hotel sectors show the biggest survey improvements, trailed closely by downtown office. Power centers and suburban offices remain investors’ least-favored subcategories. Except for apartments and industrial space, development prospects remain challenging. Interviewees showed mixed concerns about apartment construction on a market-by-market basis, but generally concurred that overdevelopment will happen, but not in 2013. They also anticipate more big-box industrial development. UL

A copy of Emerging Trends in Real Estate® 2013 is available at www.uli.org/emergingtrends.

Markets to Watch

The top ten markets ranked by survey respondents are the following:

San Francisco. In 2013, San Francisco steals the triple crown from Washington, D.C., receiving top billing in the investment, development, and housing categories. The market is driven by growth and a strong jobs outlook, led by technology and a structural change away from suburban and toward downtown locations. Continued interest in infill development is supported by one of the best transit systems in the country and a city center with walkability that is second only to that in New York City.

New York City. New York City makes a small move this year, stepping up two spots to second-best investment prospect. However, investors still seem concerned about the run-up in prices. Demographics for the city prevail, with 20 percent of the jobs being in the growing education and health care sectors, and a large portion of the population made up of the important echo-boomer cohort. Service-type jobs continue to be developed, but a lag in goods-producing jobs is a concern.

San Jose. The San Jose technology corridor continues to be a market to watch. In 2013, San Jose and the broader Silicon Valley are expected to generate jobs in a variety of fields, but most will revolve around high-technology firms. Industrial diversity is limited in San Jose and could be a concern for investors; however, the more than 6,600 technology companies based there employing more than 225,000 people make it an area of interest.

Austin. In 2013, Austin looks set to extend its trend of attracting individual and institutional investors. Expansion of commercial real estate in Austin looks likely with a population increase of 2.3 percent anticipated next year, pushed by the echo-boomer demographic group.

Houston. Energy-related employment is one of the driving forces behind the Houston market, and the city’s investment prospect ranking jumped from eighth to fifth. Survey participants believe the main buying opportunities are in the industrial sector; 50 percent believe that space in Houston is worth taking a chance on.

Boston. Rising high-technology and biomedical research and development employment continues to take the lead, boosting investor interest.

Seattle. The global center for the software industry continues to be the focus of many domestic and global investors.

Washington, D.C. Commercial real estate prices have risen since the recession, with investors regarding D.C. investments as recession-proof. However, concerns about overbuilding and costs continue to lead discussions about D.C.

Dallas/Fort Worth. Ranking behind only Houston as a job provider, the Dallas/Fort Worth job base is one of the most diversified of the 51 markets covered in the report.

Orange County, California. The metro area shows increases in rating value and ranking as an investment prospect.