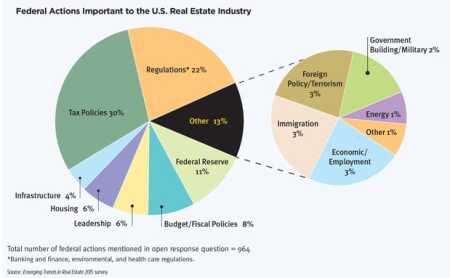

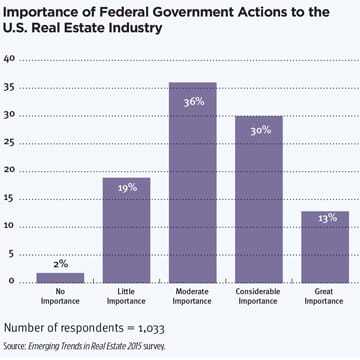

New to the Emerging Trends in Real Estate® 2015survey published by ULI and PwC, American respondents weighed in on the importance of the U.S. federal government to the real estate industry. For respondents who rated federal actions at least moderately important to the industry, the survey offered a comment box in which to indicate the federal actions that are the most important. Comments poured forth, ranging from short nouns—“taxes” and “regulations” and so on—to short essays on the government and the economy. In total, survey respondents mentioned nearly 1,000 federal actions.

Emerging Trends taps a wide range of industry experts who belong to ULI, including investors, fund managers, developers, lenders, brokers, advisers, and consultants. Nearly 80 percent of the 1,033 respondents rated federal actions at least moderately important; of these 820 respondents, 586 identified specific federal actions.

Tax Policies

Tax policies outdistanced all other federal actions, and most respondents simply stated “taxes” without elaboration. With Republicans in control of both chambers of the new U.S. Congress, comprehensive tax reform is bandied about as an area for bipartisan progress. Speaker of the House John Boehner (R-Ohio) identified comprehensive tax reform as the first point in his five-point vision for the new Congress in 2015–2016. Few Emerging Trends respondents, however, said they thought comprehensive tax reform is likely to happen in 2015.

Specific tax policies mentioned as important to the real estate industry include taxation of capital gains—especially with respect to carried interest—followed by, in order of number of mentions, the Foreign Investment in Real Property Tax Act (FIRPTA), taxation of internet commerce, income taxes, corporate taxes, and rules governing 1031 exchanges. Also called a like-kind exchange, the process allows real estate investors to defer taxes on capital gains if they invest the proceeds in a similar property, as defined by the U.S. Internal Revenue Service.

FIRPTA taxes foreign investors on their gains from the disposition of real property interests; proposed reforms target pension funds and real estate investment trusts. Reform proponents, including the White House and a bipartisan group of 40 senators in the recently concluded 113th Congress, have argued that attracting foreign investment to real estate development and infrastructure projects would help stimulate the economy and create jobs.

Regulations

Concerns about regulations also made a strong showing in the survey. Banking and finance regulations were most frequently cited, followed by general concern about unspecified “additional,” “excessive,” or “stifling” regulations. Environmental regulations came in a close third. Statements about environmental regulations in general outnumbered concerns about specific environmental policies. For those who listed specific environmental issues, most cited the importance of new stormwater and wetland regulations under the Clean Water Act. Only a handful of respondents listed federal action on climate change as important for the real estate industry in 2015.

Budget and Fiscal Policies

Of the respondents mentioning federal budget and fiscal policies, a large majority cited concerns about deficits and debt. According to the Congressional Budget Office, fiscal year 2014’s budget deficit of $486 billion was $195 billion less than 2013’s deficit. Revenues were up 9 percent over 2013’s, and outlays (spending) were up only 1 percent, helping to close the gap. The trillion-dollar deficits of the recession are long gone. As a percentage of gross domestic product (GDP), deficits have been on a five-year downward slide, and 2014’s deficit—representing 2.8 percent of GDP—was slightly below the nation’s 40-year average.

Leadership

Gridlock was the term used most frequently by respondents who commented on what they viewed as a lack of leadership in the federal government.

Federal leadership influences the economy, many believe, explaining that “the paralysis of leadership can negatively influence the decision-making process at the consumer level” and that “unpredictability does not make for a secure investment environment,” to cite some of the comments submitted by survey respondents.

High-stakes political showdowns earned scorn and frustration from respondents. “Fiscal cliff and similar standoffs erode investor confidence,” warned one respondent. Another wrote: “Do not shut down the government . . . it is bad for business.” Or, as another respondent summed it up, “Bottom line to all of this is JUST LEAD, PLEASE!”

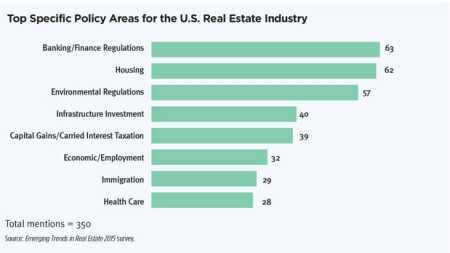

Top Policy Areas

Looking beyond the general importance of taxation and regulation, close watch of the Board of Governors of the Federal Reserve, and worries about budgets and leadership, the other federal policy areas that received more than 25 mentions include, in order of frequency: banking and finance regulations, housing policy, environmental regulations, infrastructure investment, capital gains/carried-interest taxation, economic and employment policies, immigration, and health care regulations, including the Affordable Care Act.

For those mentioning housing, reforms related to the future of Fannie Mae, Freddie Mac, and the Federal Housing Administration ranked high on the list. When combined with the mentions of the mortgage interest tax deduction, policies and programs related to homeownership made up the majority of references to housing policies. Mentions of the low-income housing tax credit and support for U.S. Department of Housing and Urban Development funding, however, numbered twice as many as of the mortgage interest tax deduction alone.

The future of Fannie Mae and Freddie Mac, the secondary mortgage market entities collectively known as the government-sponsored enterprises (GSEs), is uncertain. After falling into federal receivership during the Great Recession, they have played—and are playing—a crucial role in the recovery of the mortgage finance system. Although agreement is widespread that the federal government cannot continue to guarantee mortgages in the long term, the closest thing to a bipartisan proposal in the 113th Congress struggled in the Senate Banking Committee and was not passed. GSE reform seems unlikely in 2015; and at the end of 2014, the Federal Housing Finance Agency, which oversees Fannie and Freddie, announced provisions to broaden the availability of mortgages through new rules allowing more mortgages to be written using low downpayments.

Increased investment in infrastructure is something that Washington observers have pegged as possible for the 114th Congress. Infrastructure is traditionally a bipartisan pursuit, and the 113th Congress succeeded in passing the Water Resources Reform and Development Act and in funding investments in ports, flood management, and water infrastructure, with overwhelming majorities on the final bill. Funding for highways, transit, aviation, and Amtrak all require congressional attention in 2015, but if the past is predictive, coming to an agreement on raising the revenue to pay for identified programs will be a high hurdle.

With the Obama administration introducing dramatic new immigration policies and the U.S. Supreme Court taking up a case challenging key provisions related to subsidies in the Affordable Care Act, uncertainty and turmoil in these final two policy areas are also likely to continue well into 2015.

Action in the waning days of the 113th Congress resulted in some stability for 2015. Tense but ultimately successful bipartisan negotiations funded most of the government for fiscal year 2015, which runs through September 30. Funding for domestic programs remains flat; modest increases go to international priorities. The one exception is the U.S. Department of Homeland Security.

Its funding expires on February 27—a move sought by Republicans to keep the pressure on immigration policy in early 2015.

Despite the dismally low approval rating that most Americans have been giving both Congress and the White House, federal actions—or the lack thereof—still reverberate throughout the country, including the real estate industry.

Experience everything the Urban Land Institute offers! By joining ULI, you receive a free print edition of Urban Land Magazine, exclusive members-only content, significant discounts on events, workshops, and publications, and more.

Receive updates on similar articles from Urban Land magazine. Click here to sign up for our FREE weekly e-mail newsletter.

Sarah Jo Peterson is ULI senior director for policy.

![Western Plaza Improvements [1].jpg](https://cdn-ul.uli.org/dims4/default/15205ec/2147483647/strip/true/crop/1919x1078+0+0/resize/500x281!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fb4%2Ffa%2F5da7da1e442091ea01b5d8724354%2Fwestern-plaza-improvements-1.jpg)