- Entrepreneurial streak dates back to childhood.

- Understanding the risk/reward ratio is of paramount importance.

- The Fed’s easy money policy risks inflation.

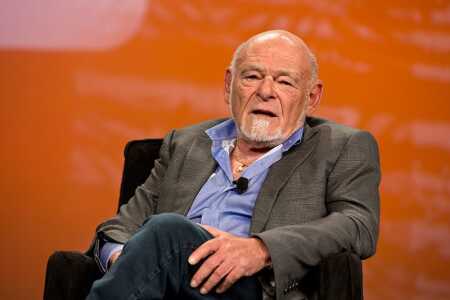

Defining risk—understanding and defining the downside of any investment—is the key to succeeding as a real estate entrepreneur, Sam Zell, founder of Equity Group Investments and chairman of Equity International, told attendees at the 2013 ULI Fall Meeting in Chicago.

“I pound on my people: taking risk is great. You’ve got to be paid to take the risk. The risk/return ratio is probably the most significant determinant of success as an investor,” Zell said.

The native Chicagoan was interviewed at a general session of the ULI meeting by Randall K. Rowe, a former Zell employee who is now chairman of Green Courte Partners, a private equity firm based in Chicago. Rowe invited Zell to explain how his personal history, as a child of immigrants who fled Poland in 1939, shaped his career.

“He believed that the streets were paved with gold and that America created the ultimate opportunity,” Zell said of his father, who was unable to convince his extended family to leave Poland, where they were lost to the Holocaust.

“I’m a big advocate of immigration,” Zell said, “not necessarily based on familial relationships. There are people all over the world who would excel in this environment,” and who should be encouraged to come here.

Zell recalled how, when he was not yet ten years old, he knew that he was “different,” and just could not go along in the same direction as everyone around him.

“I realized, if I could, quote, make money, then I got freedom because I didn’t need to ask anyone else for money,” Zell said.

His first foray into entrepreneurship started in 1953, when he was a 12-year-old living in the Chicago suburbs. He had to take the L train into the city to attend Hebrew school, and in his solo travels to school, he discovered that newsstands in the city carried a different class of publications—specifically Playboy magazine—than he could find in the suburbs. “Needless to say, I thought it was a terrific magazine,” Zell said. His suburban friends thought it pretty terrific, too, and were willing to pay him $3 for the magazines he picked up in the city for 50 cents. “That’s when I learned about margin,” Zell joked. “For the rest of that year, I became an importer—of Playboy magazines to the suburbs.”

Zell’s entrepreneurship continued through his college years at the University of Michigan and its law school, both in Ann Arbor, where he and a fraternity brother, Robert H. Lurie, invested in housing for students. Zell said he made $150,000 in 1966, his senior year of law school. “I could have stayed in Ann Arbor,” Zell said. But he felt he had to go to Chicago or another major market where he could test himself. Lurie joined him a couple of years later, when the two founded Equity Group Investments. “It was the most significant business relationship and personal relationship of my life,” Zell said of Lurie, who died in 1990.

Zell named Chicago entrepreneur Jay Pritzker as another significant mentor. “I think he was the smartest guy, business-wise, I’ve ever seen,” Zell said. “The way he looked at risk . . . he was one of the greatest investors of all time.” Zell said dealing with Pritzker for 20 years was of extraordinary benefit to him.

Today, however, Zell is highly critical of the inflationary risk he attributes to the Federal Reserve’s quantitative easing program. It even has led him to begin investing in gold—something Zell said he never found attractive because it generates no income.

“I don’t necessarily think real estate is the great beneficiary of inflation, unless you look at it on a very long-term basis,” Zell said.